It’s October 30, 2018. That means that I’ve officially been a homeowner for a year.

What have I learned since moving in? Here are the things:

The one thing that took some getting adjusting to was the extra bills. In an apartment, I was used to water/sewer/trash being included in the rent. My first water/sewer/trash bill had me like ?. I went through the breakdown and realized that the sewer amount was the highest cost. I called my mom and asked what makes a sewer bill high? How can I eliminate or lower that? Well, I can’t but I can do my best to conserve my water usage. So yes, if you visit me, please keep your shower usage to 10 minutes or less (that part is really for my mom who likes long shower however I have NEVER been able to run water like that at her house. I still can’t at 30.)

I knew I wasn’t purchasing a lawn mower nor did I want to relive my childhood of cutting grass. I hired services for that. That’s an extra cost.

My HOA assessment always seem to fall in a forgetful quarter. ? It comes every quarter but somehow I forget. All the other bills I was used to.

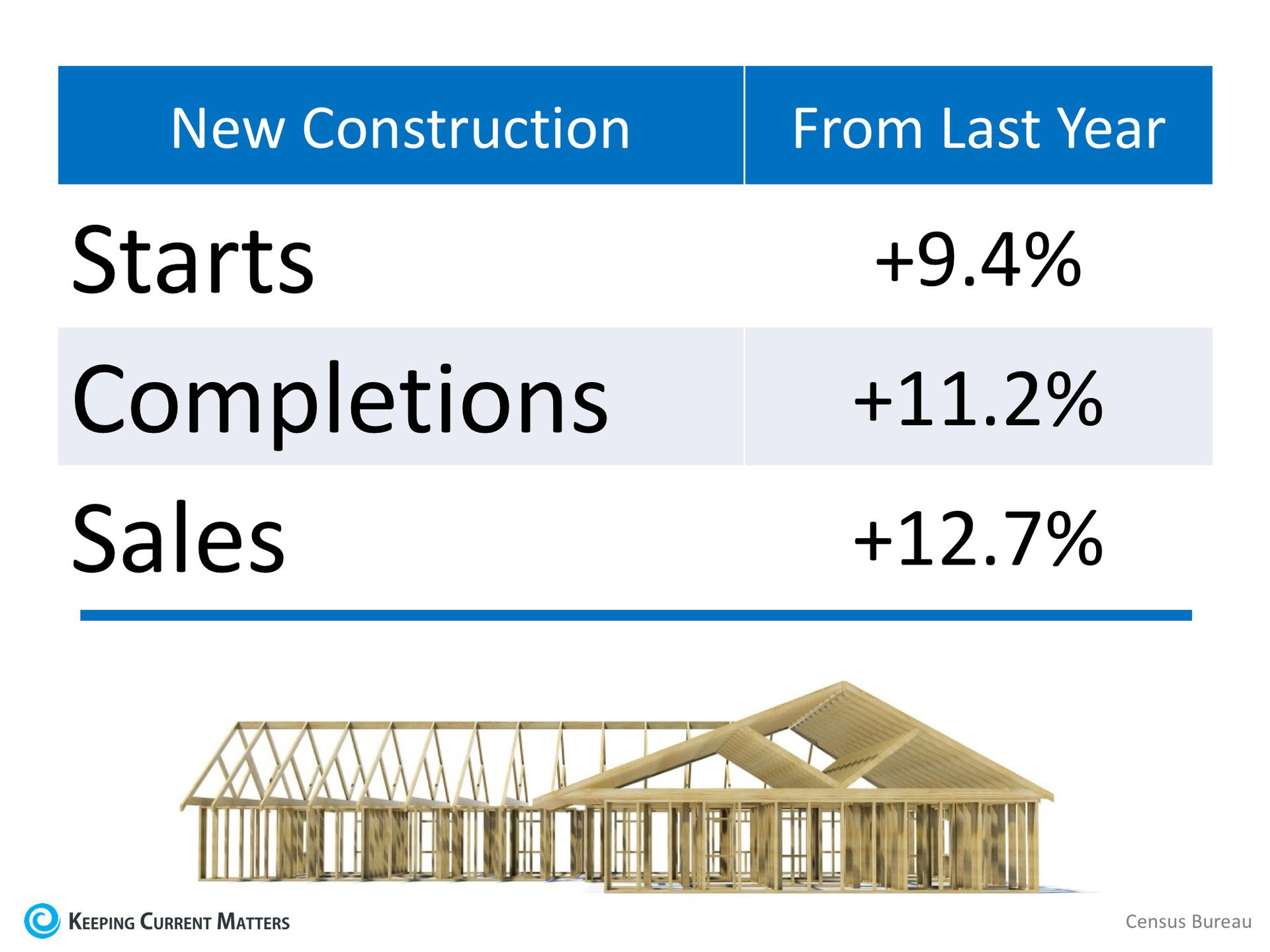

The one thing that has happened in a year was just how much my neighborhood has changed or my whole area for that fact. Last year, there was no house to the left of me.

Today, there is a 2 story home beside me. There is another one in front and one currently being built directly in front of me too. The wooded area behind me? Well it is still there but by next year, there will be houses behind me. I wanted a country feel for at least 2-3 years. Unfortunately, the growth of the area says differently. I’m happy about that. We have a Fuzzy’s Taco nearby so I’m content.

As a homeowner, I wanted to quickly finish out my home and have people visit. The one thing I learned was that your home is a work in progress. I still don’t think I’ve sat down and truly felt like “wow, I did this.” Not yet. I’m too busy at the moment. I will during this year’s holidays. I just knew when I moved in, I’d change so many things. However, after purchasing the fridge, new bed for the master bedroom, loveseat for the living room, I knew I didnt need to rush to complete my journey. I had that conversation with potential a first time homebuyer about pacing yourself for the adjustment. She quickly told me that she’d just finance everything.

As much as that can be possible, you want to take your time before doing that. Homeownership is a major focus and anything can happen. That’s one extra debt you don’t want to focus on when a repair is needed.

I quickly learned that my dreams outweighed my budget for my home. After one year, I still have builder grade items in my home (hello light fixtures I want gone…I digress.) With my style for my home, I realize I am not in a rush to find anything. I actually found light fixtures that I want but they don’t ship to the states. ??♀️

I spend some Saturday mornings at Home Depot to learn new things to do around my house. Although, I can easily hire someone to do things, I’d rather find out how to do it and save the labor cost. I’ve learned how to install a toilet, install a backsplash, lay floors, and more. I’m my own handy woman. It’s actually quite therapeutic for myself.

Remember when I said my dreams outweighed my budget, let’s talk about my master closet. So in my home, I have 2 walk-in closets in my master suite. I badly wanted to have the bigger one designed. The first quote was $5000 for one section of the closet. I quickly went to Target and bought cube storage for $600 and arranged my closet. I’ll most likely get them professionally done within the next year but for the time being I needed something to get my life together.

I still love my backyard. It is my peaceful place. I haven’t designed it yet because it costs $17,000 for my dream design and I’m trying to figure out how to have cheaper dreams.

However, Ace and I have been absolutely loving our home and still creating it to be what we would love. Yes, Ace is my dog.

The space is perfect for me and perfect for a resale in the next 4 years. I plan to stay a minimum of 5 years and maximum of 10 years. Cheers to Year One!