Is now the time to downsize? That may be a question you and your spouse have pondered. Are the kids gone off to college? Have the kids moved away and started their own family? Does the second floor of the home barely have any foot traffic? Then the answer may be, yes.

A recent study by Edelman Berland revealed that of homeowners who are contemplating selling their house in the near future 33% plan to scale down. Let’s look at a few reasons why that would make sense to many Americans.

In a recent blog post, Dave Ramsey, the financial guru, discussed the advantages of selling your current house and downsizing into a smaller home that better serves your current needs. Ramsey explains three potential financial advantages to downsizing:

- A smaller home means less space, but it also means less time, stress and money spent on upkeep

- Let’s assume you save $500 a month on your mortgage payment. In 30 years, you could have an additional $1–1.6 million in the bank to get you through your golden years.

- Use the proceeds from selling your current home to pay cash for a smaller one. Just imagine what you could do with no mortgage holding you down! If you can’t pay cash, aim for a 15-year fixed rate mortgage and put at least 10–20% down on your new home. Apply the $500 you saved from downsizing to your new monthly payment. At 3% interest, you could pay off a $200,000 mortgage in less than 10.5 years, saving almost $16,000 in the process.

Realtor.com also addressed downsizing in a recent article. They suggest you ask yourself some questions before deciding if downsizing is right for you and your family. Here are two of their questions followed by their answers (in italics) and some additional information that could help.

Q: What kind of lifestyle do I want after I downsize?

A: “For some folks, it’s a matter of living a simpler life focused on family. Some might want to cross off travel destinations on their bucket lists. Some might want a low-maintenance community with high-end upgrades and social events. Decide what you want to achieve from your move first, and you’ll be able to better narrow down your housing options.”

Comments: Many homeowners are taking the profit from the sale of their current home and splitting it to put down payments on a smaller home in their current location and a vacation/retirement home where they plan to live when they retire.

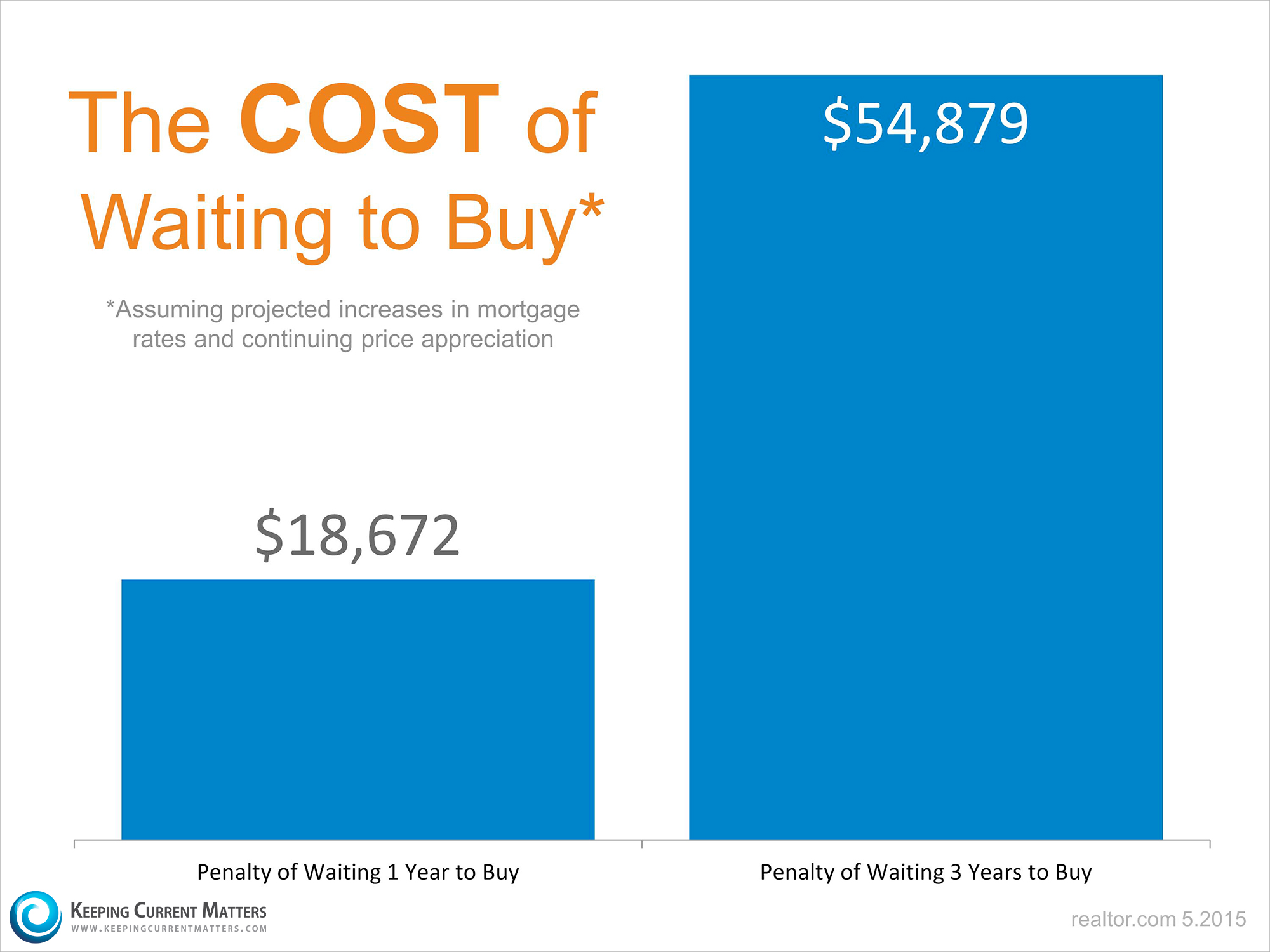

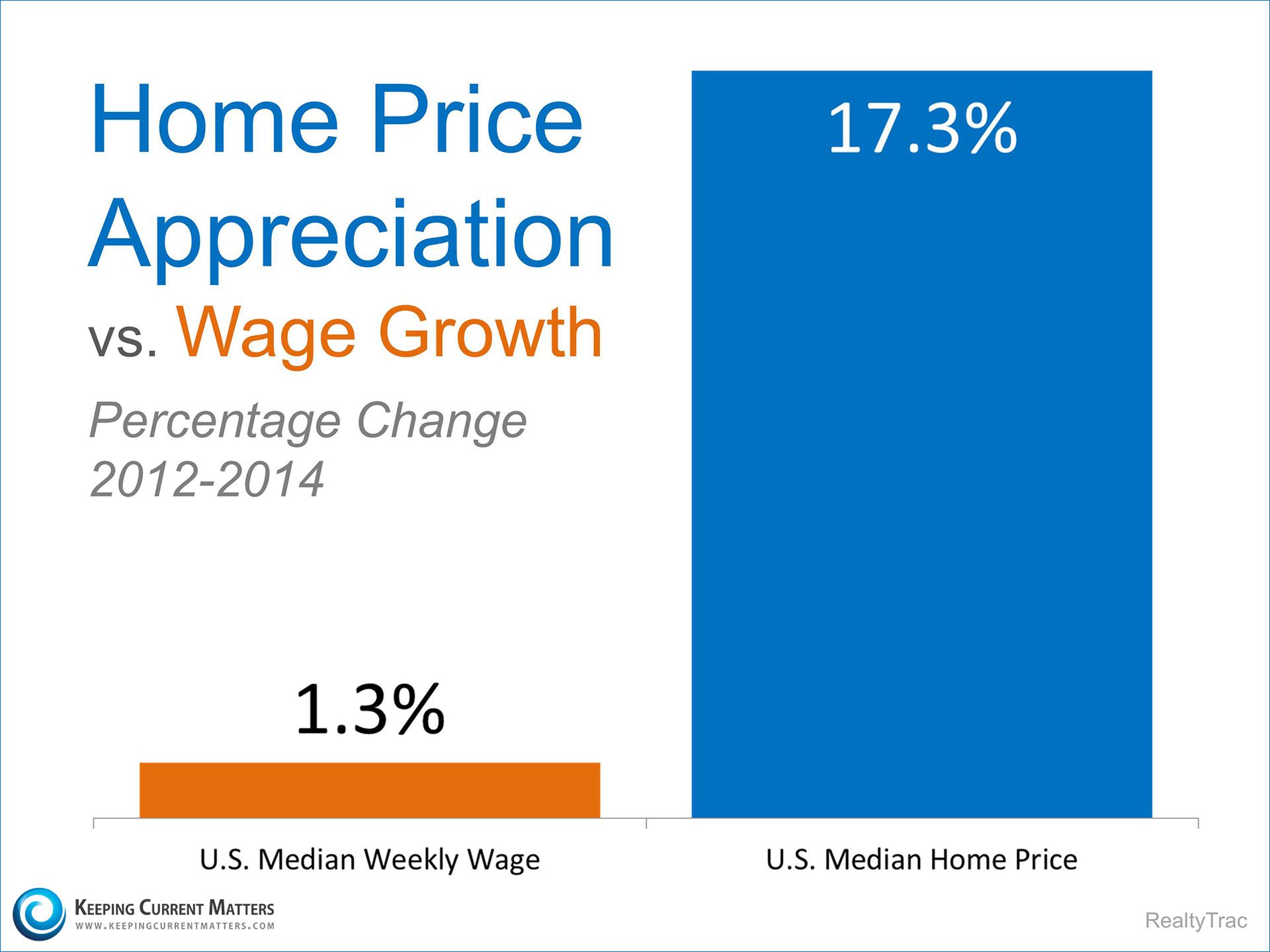

This allows them to lock in the home price and mortgage interest rate at today’s values. This makes sense financially as both home prices and interest rates are projected to rise.

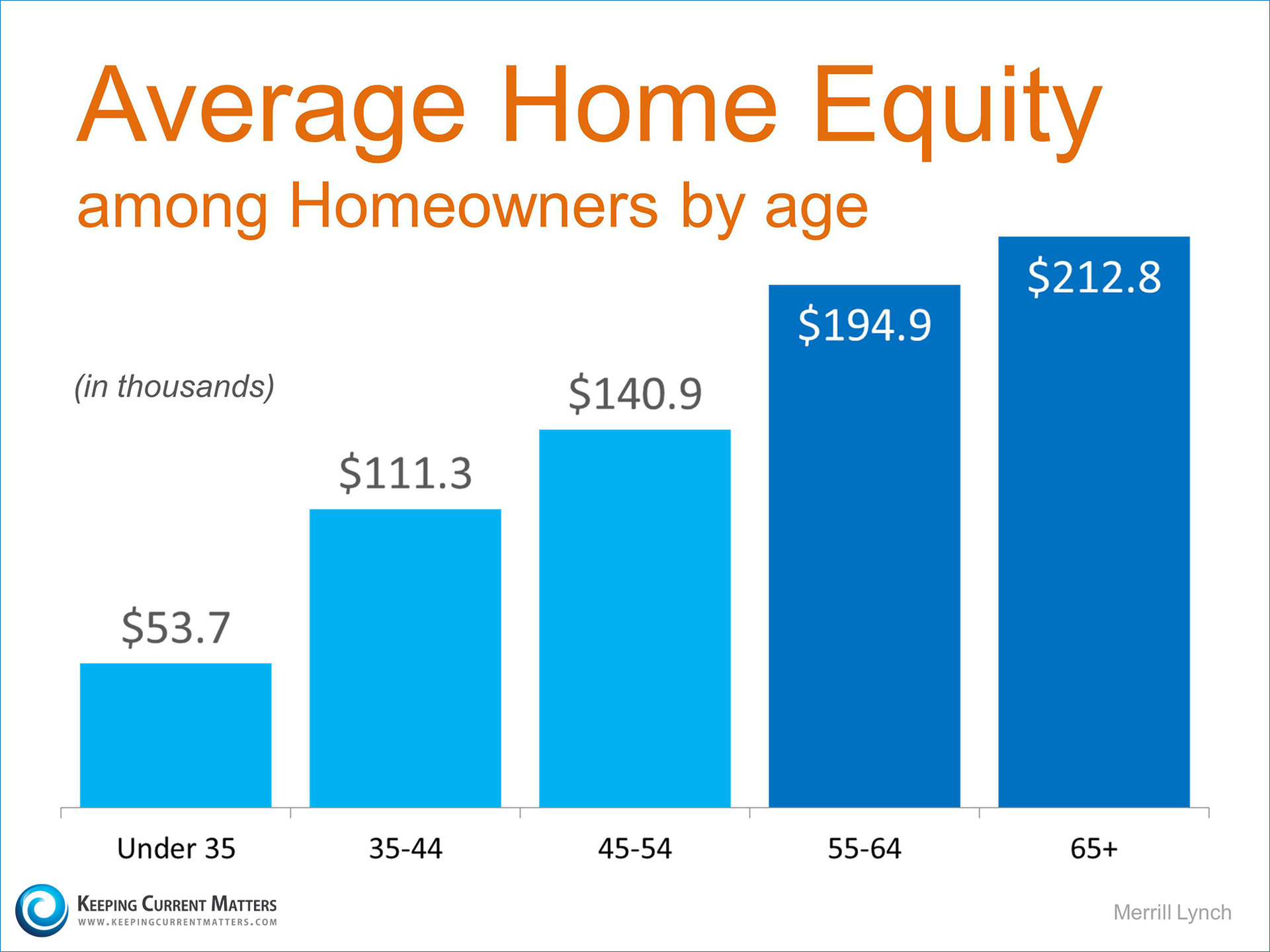

Q: Have I built up enough equity in my current home to make a profit?

A: “For most homeowners, the answer is yes. This is if they’ve held on to their properties long enough to have positive equity that will be sizable enough to put a large down payment on their next home.”

Comments: A recent study by Fannie Mae revealed that only 37% of Americans believe they have significant equity (> 20%) in their current home. In actually, 69% have greater than 20% equity. That equity could enable you to build a life you have always dreamt about.

Bottom Line

If you are debating downsizing your home and want to evaluate the options you currently have, contact Andrea T. Fowler of New Avenue Realty (972.813.9788) who can help guide you through the process.