When buying a home, taxes are one of the expenses that can make a significant difference in your monthly payment. Do you know how much you might pay for property taxes in your state or local area?

When applying for a mortgage, you’ll see one of two acronyms in your paperwork – P&I or PITI – depending on how you’re including your taxes in your mortgage payment.

P&I stands for Principal and Interest, and both are parts of your monthly mortgage payment that go toward paying off the loan you borrow. PITI stands for Principal, Interest, Taxes, and Insurance, and they’re all important factors to calculate when you want to determine exactly what the cost of your new home will be.

TaxRates.org defines property taxes as,

“A municipal tax levied by counties, cities, or special tax districts on most types of real estate – including homes, businesses, and parcels of land. The amount of property tax owed depends on the appraised fair market value of the property, as determined by the property tax assessor.”

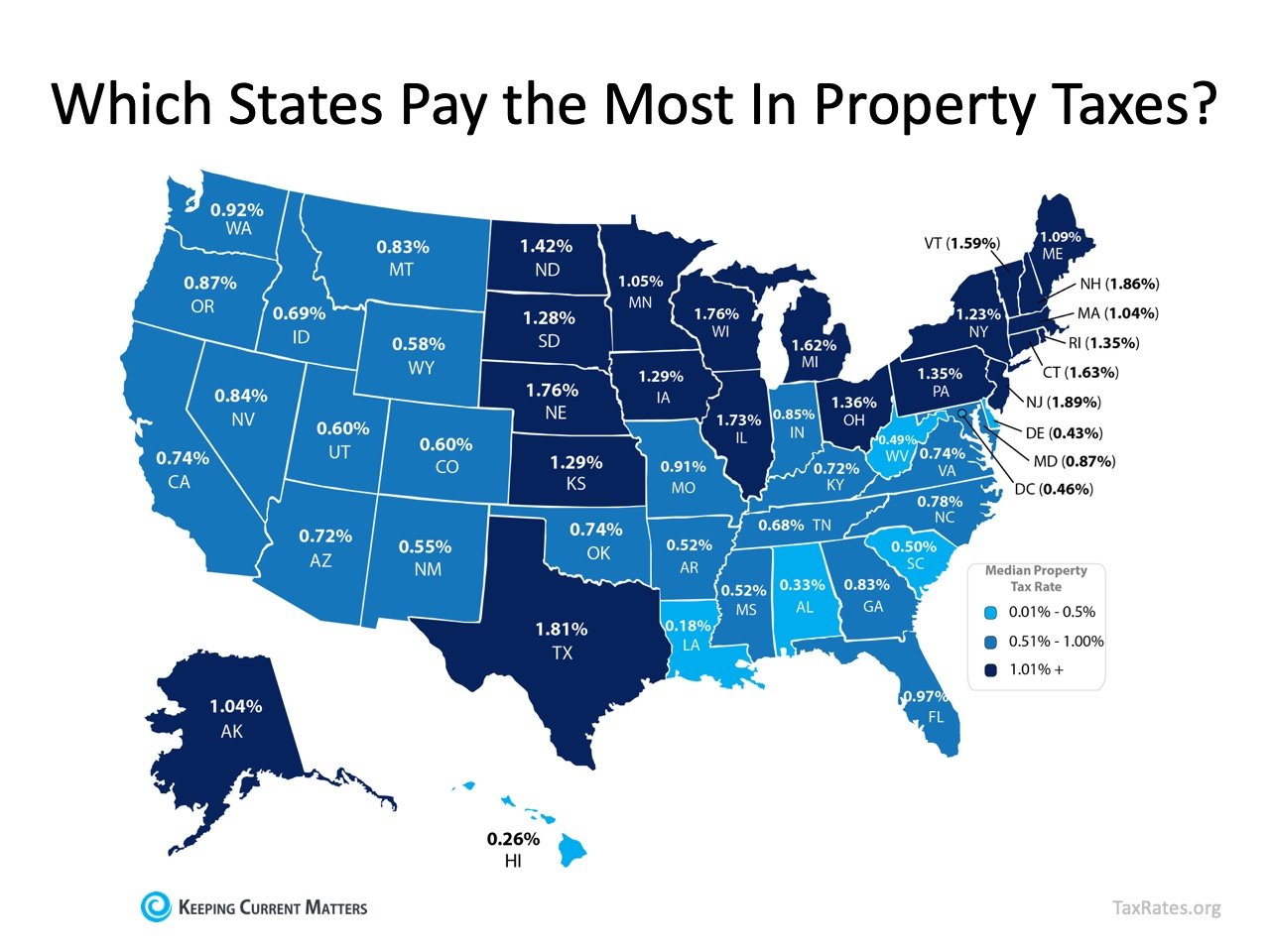

This organization also provides a map showing annual property taxes by state (including the District of Columbia), from lowest to highest, as a percentage of median home value.

The top 5 states with the highest median property taxes are New Jersey, New Hampshire, Texas, Nebraska, and Wisconsin. The states with the lowest median property taxes are Louisiana, Hawaii, Alabama, and Delaware, followed by the District of Columbia.

In Texas, we do not have states taxes which helps to pay for local services. Instead, the local municipalities are paid through property taxes. In your tax portion, you’ll notice taxing entities such as the city (“quasi city if you live in a MUD), county, school district, and any other county additions. For instance, Dallas County residents have Parkland Hospital and Dallas County Community College as additional tax entities.

Bottom Line

Depending on where you live, property taxes can have a big impact on your monthly payment. To make sure your estimated taxes will fall within your desired budget, chat with my real estate group at New Avenue Realty Group at Keller Williams today to find out how the neighborhood or area you choose can make a difference in your overall costs when buying a home.

? 972-813-9788

? info@newavenuerealty.com

? atfowlerrealtor.appointy.com