In today’s time, everyone knows everything about real estate besides the Realtor. My cousin bought a home 4 years and this is what he said. My aunt said I needed this. My Pastor said I should do this.

It’s okay to have solicited advice HOWEVER the best advice would come from a professional in that field. I have many conversations daily with others about real estate. There are some that are inquisitive and some that just tell you what it is which is rarely the truth.

Here’s the truth for people looking to buy a home.

1. You Need 20% Down to Purchase a Home

There are several different loan programs out there. You have some that require 3% down. You have some that require 0% down. Every loan product varies and it is based on your financial picture. I repeat. It’s based on your financial picture. Yours may vary from your cousin and you co-worker no matter if you make the same salary.

2. You Need Thousands of Dollars Saved

I always get asked well how much do I need to save? It depends on what type of loan product you’re using. There is no such thing as free money but there are down payment assistance programs that helps people with the down payment. You’ll need some money because there are upfront costs like your earnest money (which can range between 1-3% of the OFFER price not the sale price), inspections, option fees, and appraisals. Those things alone can be a few thousands DEPENDING on the price of the home. The good news is the earnest money (deposit on the home) and option fee (paid to seller to do your due diligence on the home) is applied towards your down payment. That means less meaning to bring to the closing table.

3. You need a credit score of 700 and Up

Credit means the world when it comes to purchasing a home. It isn’t just the score that you should worry about. It’s also the debt that is generating the score. You can qualify for a home loan with some lenders with a MIDDLE credit score of 580. What do I mean by middle? Let’s break it down. You have 3 scores from TransUnion, Equifax, and Experian. Mortgage lenders look at all 3. They take out the highest, they take out the lowest. The middle number is your credit score for the mortgage purpose. Example: TransUnion Score – 715; Equifax – 700; Experian – 728. Your credit score for this purpose is 715. For some it may make more sense to save to pay off debt than anything.

The higher the score, the better the loan and the interest rate that is available. Guess what? Rates are still low despite the fact that they’ve increased since the Presidential election.

Back to where I said the things that are generating your score is more important than the actual number. Your debt to income ratio plays the most factor on what you can afford. Depending on the type of loan you have, the lender has certain ratios to play with to determine what you can afford. Example: Let’s say you qualified for a FHA loan and you have a ratio that’s up to 55%. The 55% ratio is calculated on your monthly income BEFORE taxes. This ratio is would include how much house you can afford because it would include your debt, mortgage payment, and/or HOA.

Monthly Income: $4000

DTI: $2200 (Most you can have to spend on debt and your mortgage payment)

Debt:

- Credit Cards (Monthly Minimum Payment Here): $250

- Student Loan: $400/month

- Car Payment: $209/month

- Negative Collections: Any items reported negative takes a 5% debt towards you. Let’s say you have 5 negative items. The total of your negative items at 5% of their balances is $345.

Next you’ll subtract DTI – Debt. In this example, the total debt is $1204. That’s $2200 – $1204. That’s leaves a house payment for you at $996. Is that realistic to purchase a home? Maybe. A $996 payment is approximately a $100,000 home. It may be an $80K condo once you add in HOA dues. That’s all based on a FHA loan with 3.5% put down. As for this scenario, that’s $3,500 for a Down payment.

4. You Want to Own Where You Rent

That may be feasible but have you contacted a lender to see what you can afford? That’s one of the first steps is knowing what you can afford. The lender will provide an estimate on what you’ll need to close on a home. The smartest thing is to research what homes cost where you live. The rule of thumb is to calculate 2.5-3 times your annual salary to determine how much you can afford but your lender can give an accurate number that includes your debt.

4. You’re Only Saving for a Down Payment

There are more costs for purchasing a home than the down payment. You’ll need funds for closing costs as well. The closing costs include title fees, property taxes, lender fees, and HOA fees.

5. You Need to Be Prepared for the Cost of a Home

Now this part is where the advice comes in handy. You won’t be able to call a maintenance man but if you purchase a home warranty, it will help you save on the cost of certain expenses. I’ve had clients use them when the water heater stopped working and when the air no longer blew on the second floor of the home. Buying a home is a forced savings. You don’t stop saving because you purchased a home because anything can happen. The cost of owning a home is most likely cheaper with a home built within the previous 10 years because homes are built to be more energy efficient. There’s a builder I visited a few weeks ago and the cost to heat and cool a 3000+ home was $156.

6. You Can Only Save for Your Down Payment

There are SO MANY resources to fund your downpayment. You may be surprised when you can find the money to purchase your home with. If you’re open to living in Little Elm, Aubrey, Prosper, or anywhere north of 380, you could qualify for a USDA LOAN which requires no money down. Learn your options before thinking there is none. Here’s 9 Ways to Fund Your Down Payment.

7. Drea’s Two Cents

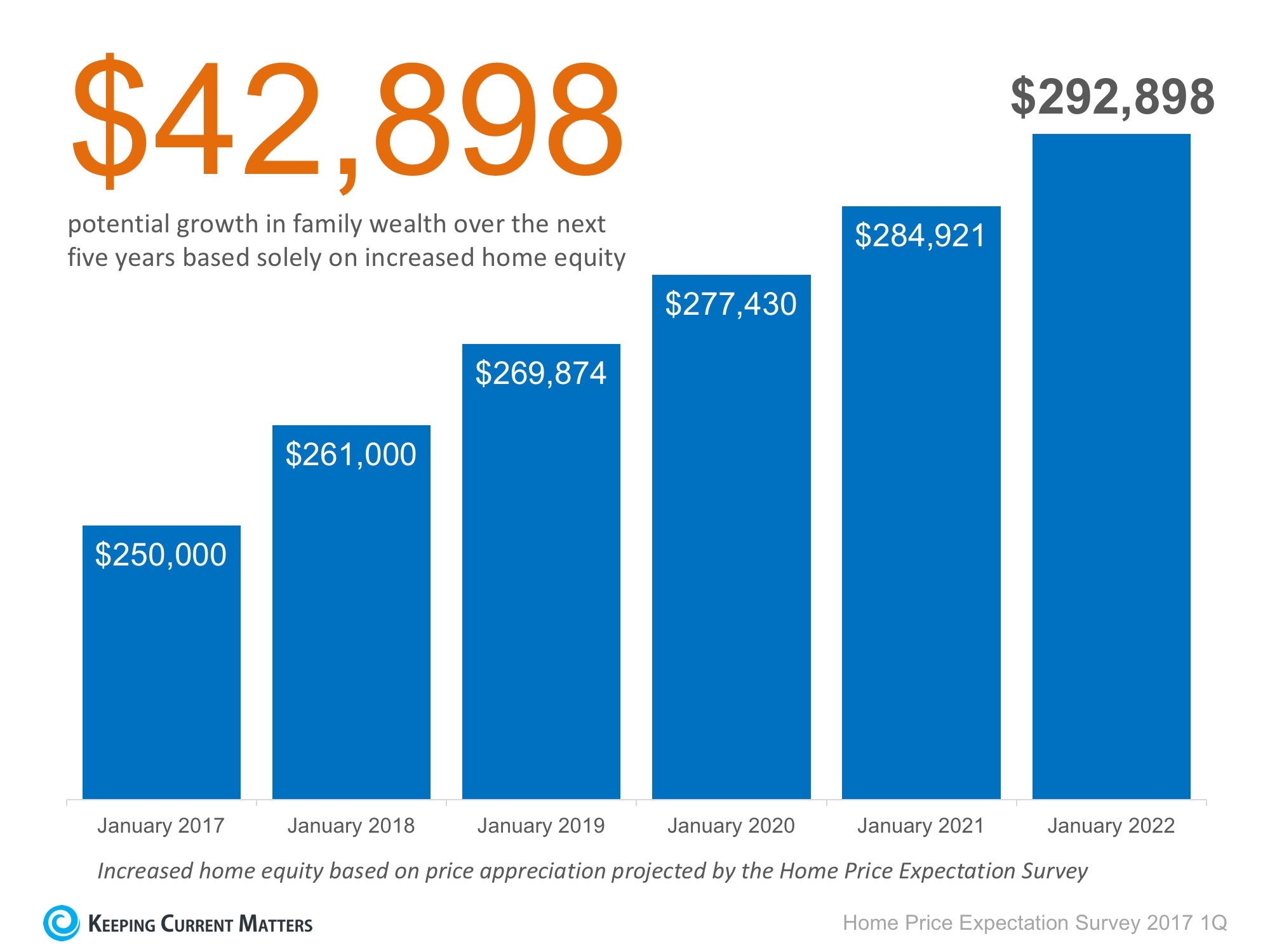

Talk to a real estate professional. I’m open to consultations for your personal situation. Be open. Yes, you may love renting in Frisco but your buying power may be Little Elm/Aubrey. Look for resale opportunities in your home purchase. The market may not always be a seller’s market. You want a home that can resale in any market. Areas are developing and redeveloping ALL THE TIME. If your area seems like nothing now, wait 5 years. I’m currently in The Colony. I lived in the area in 2011-2012 when I was in grad school and it was a forest and dead. There was no need to stop. Look at what’s happened in 5 short years. Development is happening years before you actually see it. The longer you wait, the more the prices increase. It’s okay. There are other areas to explore.

Moral of the story: Know your options. Everyone’s buying experience is different. You may be closer to being a homeowner than you think.

P.S. Everyone’s first home is the end all be all home. A starter home could be just that. A start to homeownership with a 2000 square foot home.

To schedule a consultation, contact me at 972-813-9788.