What does it mean to build a home at $800K+? How do those homes look? Are those custom built homes or nah? Join me as a I take sir down with Taylor Robinson to discuss luxury homebuying in Dallas with a production builder.

Should You Renovate or Move?

The last 18 months changed what many buyers are looking for in a home. Recently, the American Institute of Architects released their AIA Home Design Trends Survey results for Q3 2021. The survey reveals the following:

- 70% of respondents want more outdoor living space

- 69% of respondents want a home office (48% wanted multiple offices)

- 46% of respondents want a multi-function room/flexible space

- 42% of respondents want an au pair/in-law suite

- 39% of respondents want an exercise room/yoga space

If you’re a homeowner who wants to add any of the above, you have two options: renovate your current house or buy a home that already has the spaces you desire. The decision you make could be determined by factors like:

- A possible desire to relocate

- The difference in the cost of a renovation versus a purchase

- Finding an existing home or designing a new home that has exactly what you want (versus trying to restructure the layout of your current house)

In either case, you’ll need access to capital: the funds for the renovation or the down payment your next home would require. The great news is that the money you need probably already exists in your current home in the form of equity.

Home Equity Is Skyrocketing

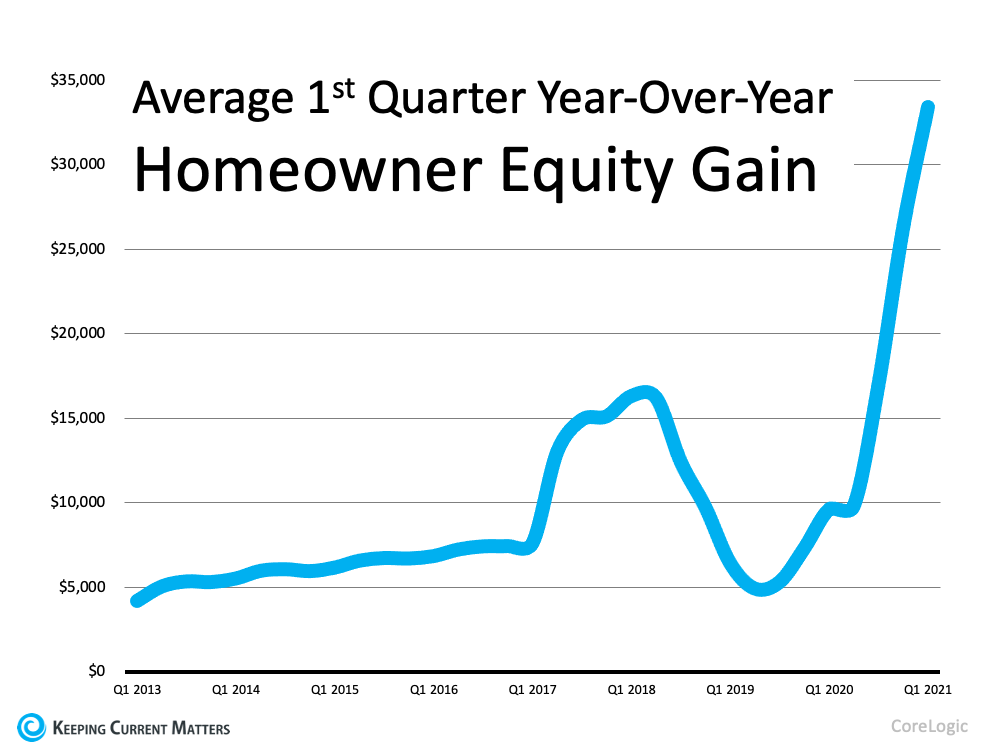

The record-setting increases in home prices over the last two years dramatically improved homeowners’ equity. The graph below uses data from CoreLogic to show the average home equity gain in the first quarter of the last nine years:Odeta Kushi, Deputy Chief Economist at First American, quantifies the amount of equity homeowners gained recently:

“Remember U.S. households own nearly $35 trillion in owner-occupied real estate, just over $11 trillion in debt, and the remaining ~$24 trillion in equity. In inflation adjusted terms, homeowners in Q2 had an average of $280,000 in equity- a historic high.”

As a homeowner, the money you need to purchase the perfect home or renovate your current house may be right at your fingertips. However, waiting to make your decision may increase the cost of tapping that equity.

If you decide to renovate, you’ll need to refinance (or take out an equity loan) to access the equity. If you decide to move instead and use your equity as a down payment, you’ll still need to mortgage the remaining difference between the down payment and the cost of your next home.

Mortgage rates are forecast to increase over the next year. Waiting to leverage your equity will probably mean you’ll pay more to do so. According to the latest data from the Federal Housing Finance Agency (FHFA), almost 57% of current mortgage holders have a mortgage rate of 4% or below. If you’re one of those homeowners, you can keep your mortgage rate under 4% by doing it now. If you’re one of the 43% of homeowners with a mortgage rate over 4%, you may be able to do a cash-out refinance or buy a more expensive home without significantly increasing your monthly payment.

First Step: Determine the Amount of Equity in Your Home

If you’re ready to either redesign your current house or find an existing or newly constructed home that has everything you want, the first thing you need to do is determine how much equity you have in your current home. To do that, you’ll need two things:

- The current mortgage balance on your home

- The current value of your home

You can probably find the mortgage balance on your monthly mortgage statement. To find the current market value of your house, you can pay several hundreds of dollars for an appraisal, or you can contact a local real estate professional who will be able to present to you, at no charge, a professional equity assessment report.

Bottom Line

If the past 18 months have refocused your thoughts on what you want from your house, now may be the time to either renovate or make a move to the perfect home.

Prices are UP & STUCK….for now!

Are the Prices TOO DAMN HIGH OR NAH?

In the beginning of 2020, the Dallas-Fort Worth marker was headed to a neutral market. Buyers were able to find homes and sellers were able to sell. No problem, right?

Then COVID hit in March 2020 and shut the country down. This left real estate to be in the unknown territory. If we are being truthful, the absolute best time to have bought a house would have been March-June 2020. I won’t say people were giving away their houses but the unknown was so unknown, you could have gotten things that you cannot think to ask of now.

As far as homes are now, today’s market is reflective of supply and demand. Due to a lot of sellers not listing within the last year, builders not being able to keep up with the demand, and buyers looking to get out of rentals, we were hit with a high demand and a shortage of homes.

If you go back to your college Economics class OR high school Civics class, when demand is high and supply is low, the prices go UP! That is what has happened to the real estate market. Still confused? Let’s use the Jordan brand of shoes for example. They only release so many each round. Soooo many people want them, once they sell out, they sell out. However, resellers know they are the most wanted shoe. They KNOW they can resell and get a higher price because the availability is limited. Welp, that’s the housing market and supply and demand.

Are the prices higher, yes? However, it is relative to the market that you see. Is it favorable? Maybe not to some but the market reacts to what it has.

Prior to 2020, the $250K and below market was vanishing from the DFW market. Now, to find homes in that range, you will have to move out in rural areas of the metroplex. The only places that have a little bit of $250K and below left is the Forney-Heartland-Crandall market and the Princeton area market. In 2021, most homes are starting the $350s. In my honest opinion, today’s $300K is yesterday’s $250K with a low interest rate. You can get a higher priced home but that doesn’t mean the higher priced home will be a larger home.

For potential homebuyers, make a list of what you feel is important to have in the first home, determine howlong you plan to live there, and what amenities do you need in and around the neighborhood. Remember, it is the first home. In order to get bells and whistles, you’ll have to pay for it. If that is not an option, reconfigure what you can spend and realistically do for the first home. Build and grow your equity to make the next home your dream home.

Your first home is typically the first step to getting to the dream home.

If you need to discuss more, book a virtual appointment with us at calendly.com/newaverealty.

Will There Be MORE Homes to Buy This Year?

If you’re looking for a home to purchase right now and having trouble finding one, you’re not alone. At a time like this when there are so few houses for sale, it’s normal to wonder if you’ll actually find one to buy. According to the National Association of Realtors (NAR), across the country, inventory of available homes for sale is at an all-time low – the lowest point recorded since NAR began tracking this metric in 1982. There are, however, more homes expected to hit the market later this year. Let’s break down the three key places they’ll likely come from as 2021 continues on.

1. Homeowners Who Didn’t Sell Last Year

In 2020, many sellers decided to pause their moving plans for a number of different reasons. From health concerns about the pandemic to financial uncertainty, plenty of homeowners decided not to move last year.

Now that vaccines are being distributed and there’s a light at the end of the COVID-19 tunnel, it should bring some peace of mind to many potential sellers. As Danielle Hale, Chief Economist at realtor.com, notes:

“Fortunately for would-be homebuyers, we expect sellers to return to the market as we see improvement in the economy and progress against the coronavirus.”

Many of the homeowners who decided not to sell in 2020 will enter the market later this year as they begin to feel more comfortable showing their house in person, understanding their financial situation, and simply having more security in life.

2. More New Homes Will Be Built

Last year was a strong year for home builders, and according to the National Association of Home Builders (NAHB), 2021 is expected to be even better:

“For 2021, NAHB expects ongoing growth for single-family construction. It will be the first year for which total single-family construction will exceed 1 million starts since the Great Recession.”

With more houses being built in many markets around the country, homeowners looking for new houses that meet their changing needs will be able to move into their dream homes. When they sell their current houses, this will create opportunities for those looking to find a home that’s already built to do so. It sets a simple chain reaction in motion for hopeful buyers.

3. Those Impacted Financially by the Economic Crisis

Many experts don’t anticipate a large wave of foreclosures coming to the market, given the forbearance options afforded to current homeowners throughout the pandemic. Some homeowners who have been impacted economically will, however, need to move this year. There are also homeowners who didn’t take advantage of the forbearance option or were already in a foreclosure situation before the pandemic began. In those cases, homeowners may decide to sell their houses instead of going into the foreclosure process, especially given the equity in homes today. Lawrence Yun, Chief Economist at NAR, explains:

“Given the huge price gains recently, I don’t think many homes will have to go to foreclosure…I think homes will just be sold, and there will be cash left over for the seller, even in a distressed situation. So that’s a bit of a silver lining in that we don’t expect a massive sale of distressed properties.”

As we can see, it looks like we’re going to have an increase in the number of homes for sale in 2021. With fears of the pandemic starting to ease, new homes being built, and more listings coming to the market prior to foreclosure, there’s hope if you’re planning to buy this year. And if you’re thinking of selling and making a move, doing so while demand for your house is high might create an outstanding move-up option for you.

Bottom Line

Housing demand is high and supply is low, so if you’re thinking of moving, it’s a great time to do so. There are likely many buyers who are looking for a home just like yours, and there are options coming for you to find a new house too. Contact New Avenue Realty Group today to see how you can benefit from the opportunities available in the Dallas-Fort Worth market.

SOURCE: KEEPING CURRENT MATTERS

Protesting Your DFW Property Tax Assessment!

Each year, respective counties send out new tax bills for the year to be paid by December. In Texas, one of the biggest expenses for homeowners are property taxes. We don’t have state income taxes therefore most local entities such as the county, school districts, county hospitals, cities, and sometimes county community colleges are paid through the property taxes.

The 2019 property tax assessments from various counties in the metroplex have been mailed out and guess what? Your property taxes have increased. What most people are seeing are a significant increase in their home value assessment (the property tax assessment value is getting really close to market values which we will talk more about later) by their counties. You have until May 15th to protest your assessment online or in person.

Did you know fewer than 20% of homeowners appeal their property taxes? This means they may pay more than their fair share. The best thing to do is to protest them. Why? You have a chance of lowering the amount you pay in property taxes by simply saying that this is too much. Let’s make a change in 2019 until the state government decides how they want to handle the property tax reform, shall we?

Here are tips to protesting your property tax assessment:

Make sure you have filed your homestead exemption.

You have until April 30th to file your homestead exemption with your county to save money on property taxes. You only have to do this once but if you failed to do it the January – April AFTER you purchased your home, this is your chance to do it. A homestead exemption helps you save money on your property taxes. It also prevents your tax value from increasing more than 10% per year.

Check for mistake’s on the county’s description on your home.

Does the county have your 3 bedrooms, 2 bathrooms, formal dining home at 1805 square foot as 4 bedrooms and 3 bathrooms at 1925 square feet? It happens all the time and no one corrects it. A lot of county information is incorrect but we let it ride as gospel. Check your county’s website to make sure the square footage, number of bedrooms and bathrooms, and lot size are accurate in their assessment.

Gather Your Comps

It is important to keep up with the values of homes in your neighborhood. Most time people don’t realize what other homes are selling for. To gather more accurate comps, connect with a local REALTOR to see what homes have sold for within the last 3 months or 90 days in your neighborhood.

You can enter your address below to determine what your home is worth.

Highlight Flaws in Your Home

We all love our homes and it is the best thing since slice bread. However, this is the time to really compare your home and get very judgmental about it. If you notice most of the homes that have sold nearby all have hardwood or some wood-like material, while you have carpet everywhere, take pictures of it. If you know your home is in need of a new roof or has foundation issues, take pictures and/or provide the quotes of those repairs that are needed.

Consider the negative influences near your nearby such as backing up to a busy street, water tower behind the home, or being on the main road to the neighborhood. Those are items that an appraiser would dock off your home’s market value when it is time for you to sell, use it to your benefit for your property taxes. P.S. I am not saying to trash your home or that you won’t ever be able to sell your home, this is to save money on your property taxes. I sold a home in Fort Worth last year and my clients ended up getting the property for less because the appraiser thought it was in a less desirable location than other homes comparable to it. It’s a gorgeous home and my clients love it. However, they got a win to buy it at a lesser price.

New Construction Woes

In most cases for newly built homes, there is a tricky line for homeowners. The previous year, your home was assessed based on land value. Now, it is based on the value of the home with a home on it. Check the price of the home that they county says your home is. Is it higher than what you paid for the home? Is it higher than what new homeowners can build the same exact home for? If your answer is yes to either one, that’s your protest. Texas is a non-disclosure state. In order to win the battle on the first one, you may have to show what you paid for your new home. The other option is to stop by the builder’s office (if they are still in the neighborhood) or pull it offline and see what your home is being sold for at base price. Is it lower than the county’s assessment? If so, your argument here is that your home has been lived in. No one is going to purchase your home for higher than what they can build their home for. Then take pictures of the things that you got standard (if you built) with the builder and haven’t updated.

Check Local Real Estate Trends

In addition to talking to your REALTOR for comps, ask them to pull the real estate trends. Homes have the potential to increase in value or appreciate. However, a property can decrease in value or depreciate. Is the price of homes sales decreasing in your zip code? A decrease in value can be caused in excess supply, lack of demand, deflation or other reasons that take away the property value. Home values fluctuate so don’t get nervous. It is just something for you to know and use in your protest. Homes appreciate normally 2-4% a year. Find out what is happening in your local area. It can be completely different from Aubrey to Crowley.

It can be that your area isn’t appreciating as much as the county THINKS it is appreciating.

Things to Remember

The county’s assessor’s don’t see the inside of your home. They can only see the outside of it. This is the time to show and prove what your home looks like. Use the knowledge that you have from the tips above to help lower your tax assessment value which in return lowers your property taxes. After you have your evidence, schedule an appointment with the county to present your case OR present the information online. It is important to protest annually to minimize your property taxes.

If you need any assistance in gathering information to present your case, contact me at via email at [email protected].

Let’s Talk About Affordability

Rising home prices have many concerned that the average family will no longer be able to afford the most precious piece of the American Dream – their own home.

However, it is not just the price of a home that determines its affordability. The monthly cost of a home is determined by the price and the interest rate on the mortgage used to purchase it.

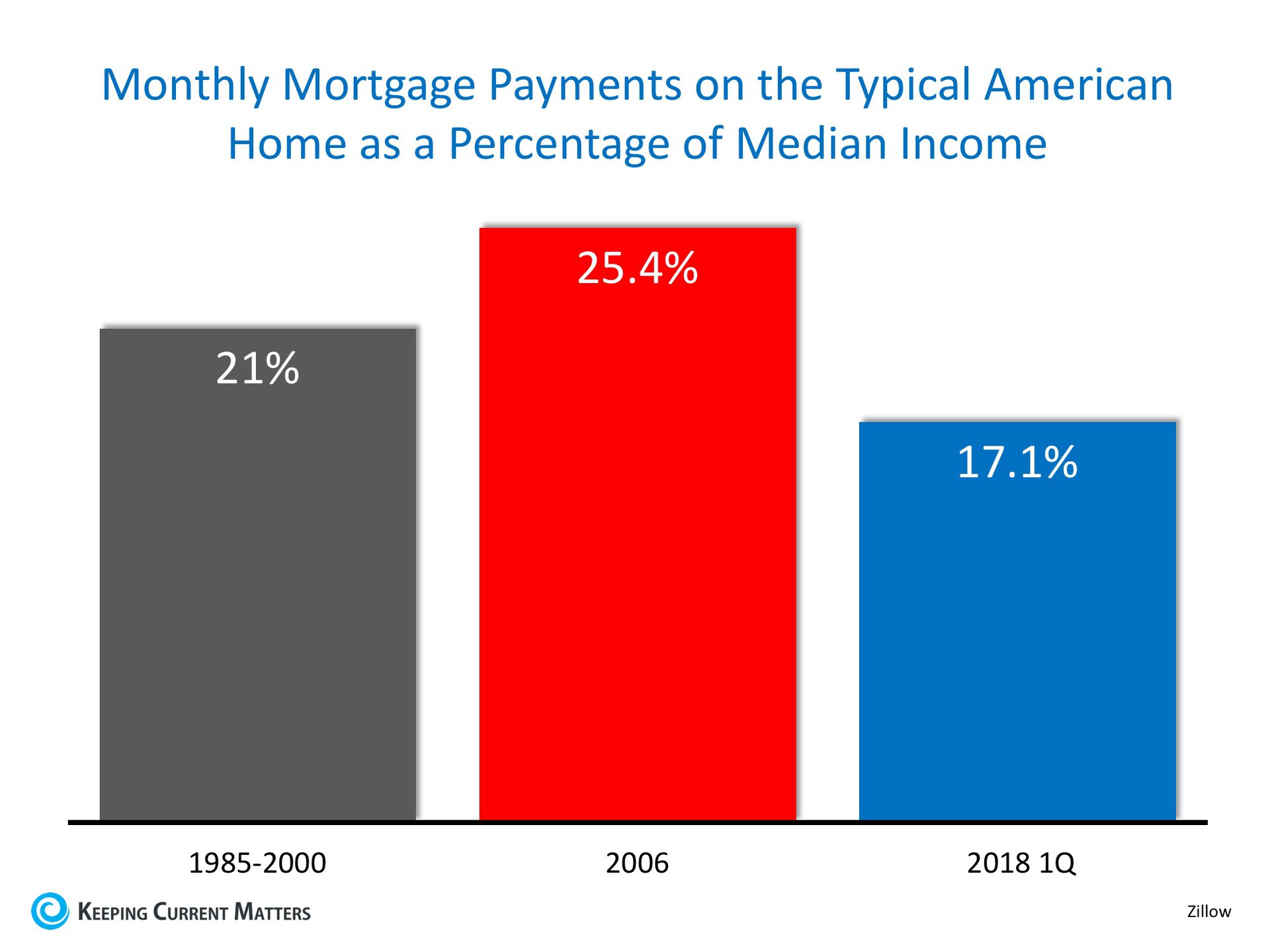

Today, mortgage interest rates stand at about 4.5%. The average annual mortgage interest rate from 1985 to 2000 was almost double that number, at 8.92%. When comparing affordability of homeownership over the decades, we must also realize that incomes have increased.

This is why most indexes use the percentage of median income required to make monthly mortgage payments on a typical home as the point of comparison.

Zillow recently released a report comparing home affordability over the decades using this formula. The report revealed that, though homes are less affordable this year than last year, they are more affordable today (17.1%) than they were between 1985-2000 (21%). Additionally, homes are more affordable now than at the peak of the housing bubble in 2006 (25.4%). Here is a chart of these findings:

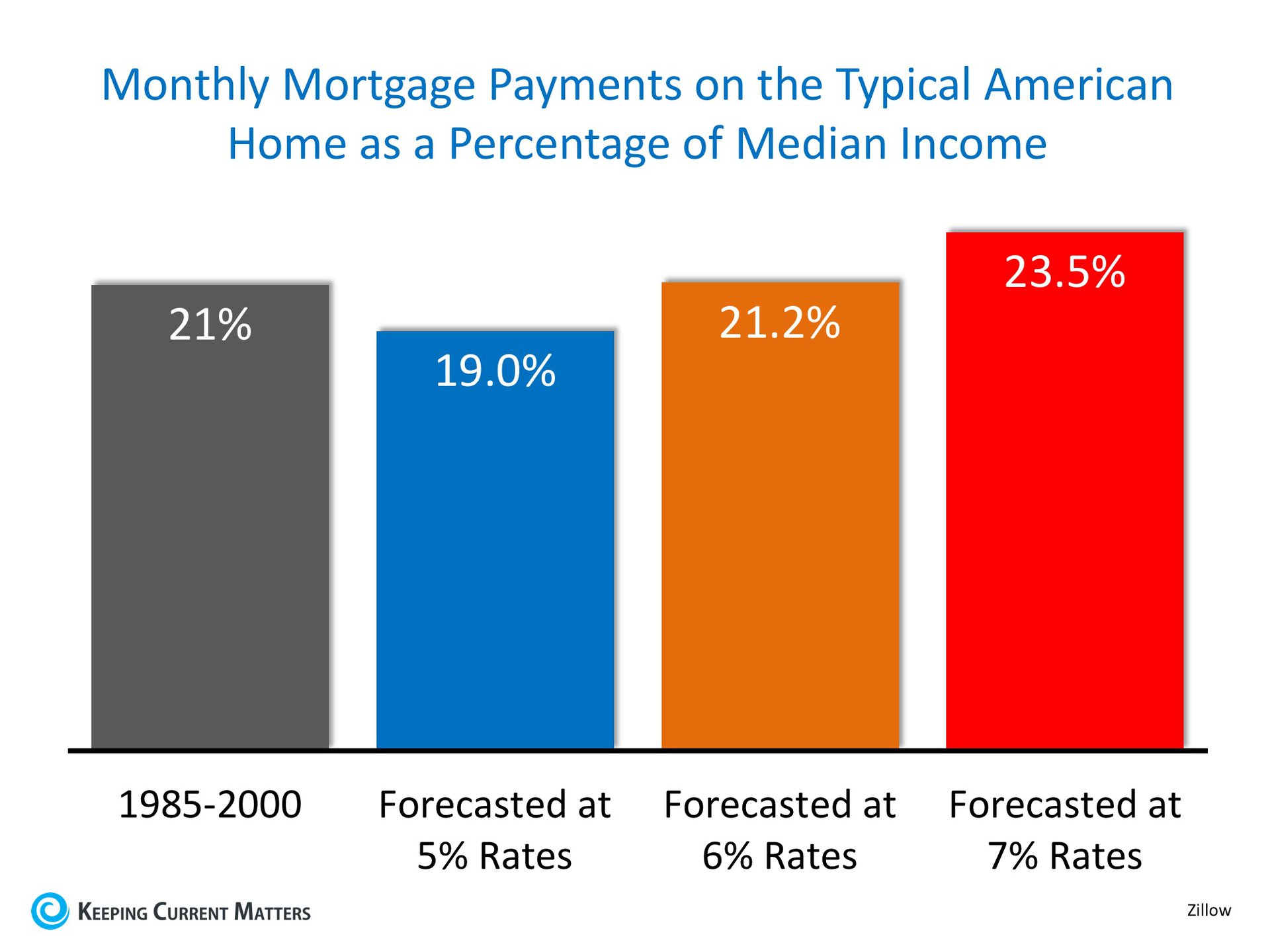

What will happen when mortgage interest rates rise?

Most experts think that the mortgage interest rate will increase to about 5% by year’s end. How will that impact affordability? Zillow also covered this in their report:

Rates would need to approach 6% before homes became less affordable than they had been historically.

Bottom Line

Though homes are less affordable today than they were last year, they are still a great purchase while interest rates are below the 6% mark.

Is Moving Up More Affordable in 2018?

If you are considering selling your current home, to either move up to a larger home or into a home in an area that better suits your current family needs, great news was just revealed.

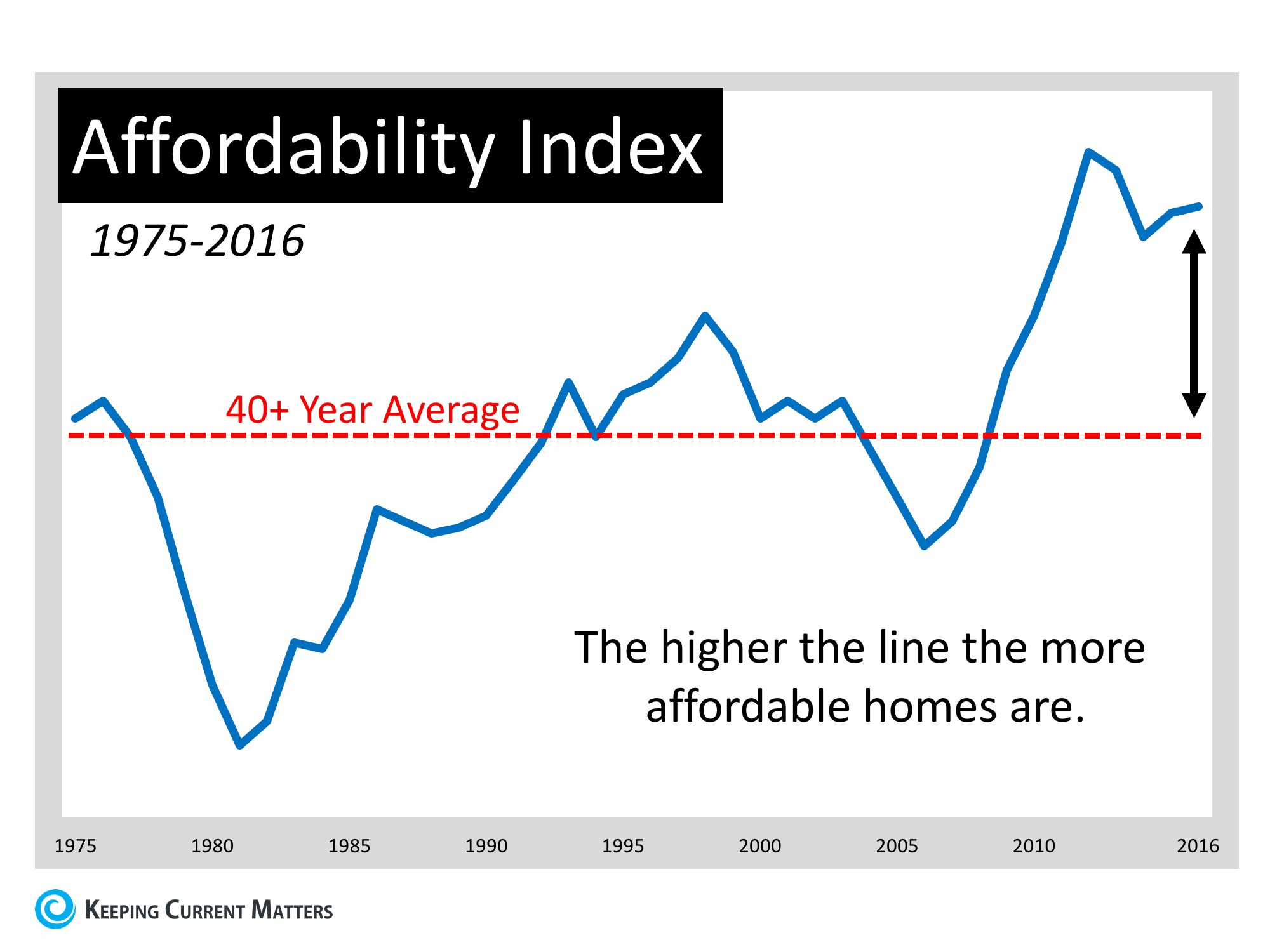

Last week, Trulia posted a blog, Not Your Father’s Housing Market, which examined home affordability over the last 40+ years (1975-2016). Their research revealed that:

“Nationally, homes are just about the most affordable they’ve been in the last 40 years… the median household could afford a home 1.5 times more expensive than the median home price. In 1980, the median household could only afford about 3/4 of the median home price.

Despite relatively stagnant incomes, affordability has grown due to the sharp drop in mortgage rates over the last 30 years – from a high of over 16% in the 1980s to under 4% by 2016.

Of the nation’s 100 largest metros, only Miami became unaffordable between 1990 and 2016. Meanwhile, 22 metros have flipped from being unaffordable to becoming affordable in that same time frame.”

Here is a graph showing the Affordability Index compared to the 40-year average:

Moving up Is MORE Affordable Now Than Almost Any Other Time in 40 Years | Keeping Current Matters

The graph shows that housing affordability is better now than at any other time in the last forty years, except during the housing crash last decade.

(Remember that during the crash you could purchase distressed properties – foreclosures and short sales – at 20-50% discounts.)

In DFW, the median sales price for February 2018 was $248,250 which is an increase of 5.6% of appreciation whereas normal appreciation rates are between 2-4% per year.

There is no doubt that with home prices and mortgage rates on the rise, the affordability index will continue to fall. That is why if you are thinking of moving up, you probably shouldn’t wait.

Bottom Line

If you have held off on moving up to your family’s dream home because you were hoping to time the market, that time has come. Let New Avenue Realty at Keller Williams help you learn your options to your future. Contact us at 972-813-9788 or [email protected].

From “I Do” to Sold

Newlyweds are saying “I do” to each other, and equate to over half of first time home buyers that are also saying “I do” to their dream homes. It makes sense! When you put two hearts together, the time comes to find a home to nourish that love. A home that brings two of your places together, and makes it one. If you and your spouse are ready to fall in love with the perfect house together, here are five tips to make sure the process goes smoothly, and you come prepared.

1. YOUR WEDDING BUDGET: Your wedding is a one-time event that shouldn’t be less than what you’d imagine. It’s a beautiful time to put all of your dream pieces together. However, it’s best to sit down and find out ways you can shift the budget to help with your down payment for a home, if you plan to purchase. The average couple spends a little over $20,000 on their wedding. Even a savings of $5000 from your wedding budget can help with owning the perfect home.

2. WEDDING GIFTS: Wedding bliss comes with wedding gifts. Let’s admit, one of our favorite times during the wedding season is all of the gifts that come pouring in! Have any friends or family pitching in cash? Save that to put towards your down payment. And depending on the generosity of your gifts, you can even open an account dedicated to your down payment, that friends and family can gift to.

3. GET PRE-APPROVED: One of the least brought up conversations in relationships is the credit and financial history of your soon-to-be spouse. Get together with a lender to go over both of your histories to know what needs to be done to put you guys in a position to own together. In some cases, only one person can get approved, while the other can’t. If you want to put both of your incomes toward the cost of the house you want, talking to a lender early on can ensure you are prepared to make the right moves.

4. THE RIGHT AGENT: That’s where I come in! For starters, I can connect you with a lender to ensure you guys are being watched over from the best recommendations. And it’s an absolute joy to take the stress out of buying a home for my newly wed couples. We all know how stressful, although joyous, a wedding can be. To then jump into buying a house shortly after, well, it’s certainly a lot to get through. But I can guide you through all of the steps to make sure you end up with a house you love. Just think of me as a wedding planner, but for homes.

5. NOW THERE’S TWO: Although some spouses are a match made in heaven, loving and adoring the same exact things, often times that’s not the case with most couples. You still are your own persons, and have your own tastes. This is where the first step to comprise really begins. Spending a good bit of money on a place you both will love and call home. A happy marriage starts with a happy home, so be sure you both are considerate of each other’s wants and needs in style and location, so you both are happy with the home you end up getting.

Let’s start the chat to happily ever after. Visit newavenuerealty.com to search for your future marital home.

Rent is Increasing! Why You Should Look Into Homeownership.

Recently, WFAA released an newcast stating that the rent rates in DFW are increasing month-to-month. All across DFW, you will see development happening. The developments are for new businesses, new apartments, and/or new homes. There isn’t too many places where you don’t see that in DFW. Currently, Dallas is the land of opportunity.

The newly published April 2017 Dallas Rent Report shows prices across the city remain above the national media. On average, one-bedroom apartments were leasing for $1,260. Two-bedroom units were renting at $1,760.

There are thousands of people relocating here monthly (so yes, people are coming here and they need a place to live). As a Realtor, I have people coming from everywhere. It isn’t a specific place that people aren’t migrating from. They come from the East and West Coasts, other Southern states, and the Midwest.

My biggest motto from a financial standpoint is that if you are paying $1000+, you should consider purchasing a home. Why? The benefits of being a homeowner outweighs being a renter. Let’s take this example.

Let’s say your monthly rent is $1200/month. For a whole year, you’ve paid $14,400 in rent. However, if you had a home that was $1200/month for your mortgage, you could have tax benefits from property taxes, mortgage insurance, mortgage interest. The $14,400 you spent with a mortgage with a tax benefit of $3,600 means that you technically have paid $10,800 for a whole year. That’s basically $900/month. What’s even better? You are build equity while buying and equity = wealth. With an apartment, you are making the developer/builder wealthy.

Homeownership is an investment. Yes, you can invest in stocks and bonds but homeownership provides you a tangible asset. Homeowners in DFW have seen an increase in their asset of 8.5%. That’s extra money that you have made and all you did was live in a home. Can you say the same about your apartment? I live with the financial sense of wanting to make money while I sleep. That is EXACTLY what a home does. Check out the graph below on the status of DFW homes from 2014 to now.

The market has went from homes having a median sales price of $162,000 to $255,000 in June 2017. That’s a $93,000 increase in 3 years. Listen to me, that’s $93,000 increase in THREE years. Imagine what you could do with $93,000 if you had a home to sell. That’s 20% down for a move-up home and some left over to decorate and pay Navient (Sallie Mae’s wicked sister) a nice chunk of change.

Bottom Line: You could look into purchasing a home instead of renewing your lease. Homeownership can be a condo, townhome, or a house. The first two really depends on a person’s lifestyle and what they prefer. All three can be considered a home that you’ve purchased. I think condos/townhomes are great for turning into easy rental properties whether short term (Heard of Airbnb or Homeaway?) or in the long-term. You have to weigh your options and what works best for you. The easiest way to get to the McMansion is to purchase your first home and build yourself and your wealth from there.

For more detailed information for your personal situation, contact me at 972-813-9788 or [email protected].

New Communities in Dallas Suburbs

As a Realtor, I love finding new communities in Dallas suburbs before information is released publicly. It helps my clients beat the rush and get in on pre-sale prices. Now some communities may have an advertisement or two but not all model homes have been built in the community. Recently, I had a relocation buyer looking to build a home in the suburbs. She saw a community but wasn’t quite sure of it. We both went to visit it and discovered the three builders in the community.

From there, I went on to find more information and which builder fit her price range. We not only found one that did her price range but one that had their upgrades as standard options for her. We had pre-sale prices and even after she built the home out the way she wanted, we still didn’t reach her max budget. Can we say SCORE?!

If you follow me on Instagram, you will see that I absolutely love new construction. It is my thing for my clients. I like resale as well but I understand that some clients like the thrill of new. I understand. It is like the difference between new car sales and used car sales. The used car sales are great for your budget and timing. The new car sales come with a sticker price. It is somewhat equivalent to it. I love to help clients build their “perfect” home for now. I placed “perfect” in quotations because there is no such thing as a perfect home.

Below are a few communities that I have found while out on the search as well as some from my builder relationships. If you are interested in any of these communities, contact me. Seriously, I always get the question of whether you need an agent purchasing new construction. YES! The sales representative represents the builder. Who is representing you? It’s free representation for you so why not have someone represent you. Agents can help you negotiate the deal, understand what will help you in the resale process (if you are building), and explore your options. You don’t want to get caught up in the beauty of the model homes. Yes, they are staged well and you will be ready to hand over your whole checking account but an agent can help you weigh the pros and cons. So if you are interested in buying a built home in a community or building one, contact me to walk you through it.

Lakewood Hills – “New Carrollton” as they as describing it but it’s basically the Lewisville area outside of Castle Hills on Josey Lane and 121 Toll. As of now, I know Pulte Homes and Beazer Homes will be in this community.

Willow Wood – Located in McKinney. Builders in this community consist of First Texas Homes, Chesmar Homes, and Bloomfield Homes.

Winn Ridge – Dirt hasn’t even been built up yet for this community but it is coming soon. The only builder I can find so far is Centex Homes. Pre-sales start in summer 2017!

Windhaven Crossing – Townhome communty by DR Horton and Megatel Homes Pricing has yet to be revealed.

Melton Ridge – Located in the Stonebridge Ranch community in McKinney. New homes are being built by American Legend and Shaddock Homes.

There will be more updates as I receive them about new communities in North Texas. To sign up to receive more information, head to my website at NewAvenueRealty.com.

Find out where I head on Wednesday with my #WOWWednesday posts.