That’s the question in America. According to the video below, foreclosure rates are at its lowest that it’s been since the recession in 2009. What does this mean?

It means that rates may not be as low as they are now. It means no low bids on homes that are priced right. In the DFW market, foreclosures are few and far in between (in Denton and Collin Counties today, there are 33 active foreclosures). One thing that most buyers ask me is, can you send me foreclosures? They are listed on the market and the reason you may think it is not is because there aren’t many. Plus, if there is a foreclosure it does not mean they are extremely cheap. The deals that you are looking for are gone. As much as I hate to say this because we all love a deal, right? You missed the boat on a deal for a home. That boat sailed in 2008-2011.

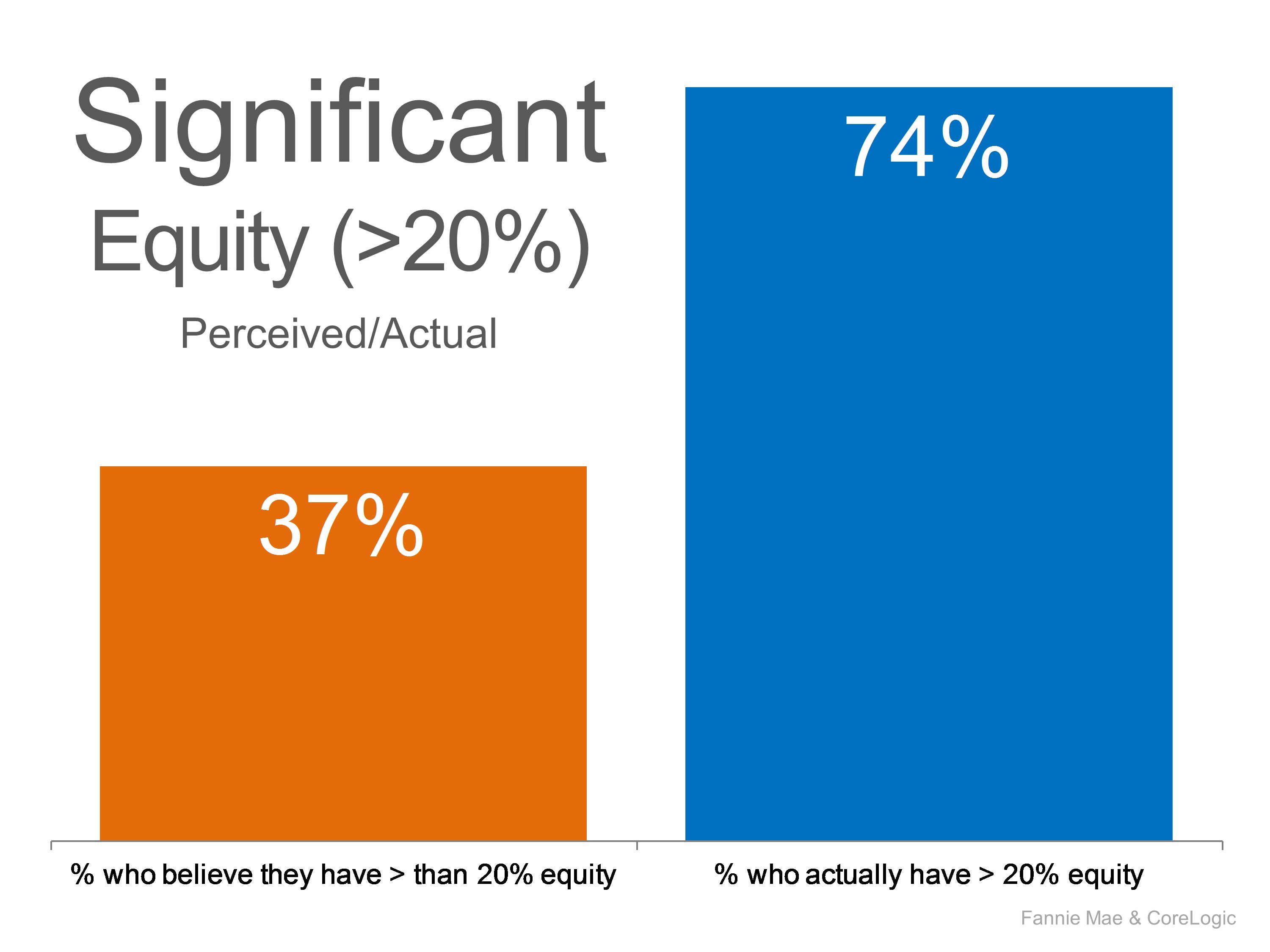

A great deal would be when you and the seller can agree to a price and it appraises for that price or higher. For your sake as a buyer, higher means a lot more for you. It means that you have some equity in the home on closing day (Equity = market/appraised value – loan value). Be competitive and ready to make a great deal. I counsel my buyers by letting them know that you should submit every offer as if there are multiple offers because you won’t always get a second chance. Your first offer should be your highest and best. Now if you are looking to have tens of thousands dollars off the list price, bring all cash to the table and that’s a different conversation. Cash rules, remember that if you don’t remember anything else I say. Is it all cash at the end of the day? Yes but that person won’t have loan contingencies, closing costs needed, and can close in a week or two. My advice to home shoppers will be to bring your A-game. We’ll need it to make it to the finish line.