Is spring closer than we think? Depending on which Groundhog you witnessed a few days ago, you may have less time than you think to get your home on the market before the busy spring season.

Many sellers feel that the spring is the best time to place their home on the market as buyer demand traditionally increases at that time of year. However, the next six weeks before spring hits also have their own advantages.

Here are five reasons to sell now.

1. Demand is Strong

Foot traffic refers to the number of people out actually physically looking at homes right now. The latest foot traffic numbers show that buyers are still out in force looking for their dream home. These buyers are ready, willing and able to buy…and are in the market right now!

Take advantage of the strong buyer activity currently in the market.

2. There Is Less Competition Now

Housing supply just dropped to 3.9 months, which is well under the 6 months’ supply that is needed for a normal housing market. This means, in many areas, there are not enough homes for sale to satisfy the number of buyers in that market. This is good news for home prices. However, additional inventory is about to come to market.

There is a pent-up desire for many homeowners to move, as they were unable to sell over the last few years because of a negative equity situation. Homeowners are now seeing a return to positive equity as real estate values have increased over the last three years. Many of these homes will be coming to the market in the near future.

Also, new construction of single-family homes is again beginning to increase. A study byHarris Poll revealed that 41% of buyers would prefer to buy a new home while only 21% prefer an existing home (38% had no preference).

The choices buyers have will increase in the spring. Don’t wait until all this other inventory of homes comes to market before you sell.

3. The Process Will Be Quicker

One of the biggest challenges of the housing market has been the length of time it takes from contract to closing. Banks are requiring more and more paperwork before approving a mortgage. There is less overall business done in the winter. Therefore, the process will be less onerous than it will be in the spring. Getting your house sold and closed before the spring delays begin will lend itself to a smoother transaction.

4. There Will Never Be a Better Time to Move-Up

If you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by 5.4% over the next 12 months according to CoreLogic. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30-year housing expense with an interest rate below 4% right now. Rates are projected to rise by three-quarters of a percent by the end of 2016.

5. It’s Time to Move On with Your Life

Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should?

Only you know the answers to the questions above. You have the power to take back control of the situation by putting your home on the market. Perhaps, the time has come for you and your family to move on and start living the life you desire.

That is what is truly important.

On the other side, here is the top reasons why you should buy before Spring.

- Serious Sellers with Serious Deadlines.

There are less people moving out or buying during winter season because of Christmas and End of the year activities that needs to be done. This means there are a lot of great properties which were listed during winter but was not sold, sometimes that also means price reduction.

2. New year New you

A lot of people believes in starting fresh at the start of the year, some of these individuals have just started looking around and do not have everything they need to get ahead of the home buying process which is why they normally end up buying in Spring. Get ahead of the herd by getting pre-qualified and talking with a lender to know your buying limit and save time.

3.Get a Great Price for Listed Properties from Winter

Like mentioned above, lots of properties are still in the market from winter. This is the time where sellers are usually active and likely to be in negotiating mood for their property. Try to contact a seller immediately if you see a house that suits your needs.

4. Vacation time is over

Tried to contact a seller during Christmas time and did not get a reply? This is the best time to send a follow up as most people are back to business. You are more likely to get a home if you follow up with a seller to let them know that you were first in line if there are others who are interested in the property as well.

5. Less Competition

Do not get caught in the Spring Trend of the Real Estate market. Prices go up and great properties are being sold by the minute. Get first pick of the best property by getting a headstart!

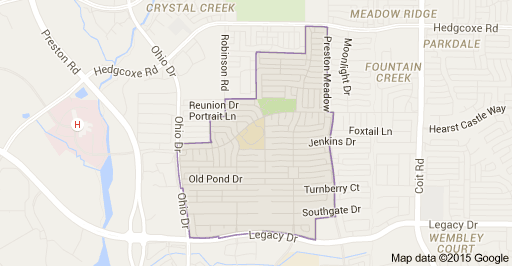

For more information about selling your home, contact New Avenue Realty (Keller Williams Realty – Dallas Preston Road) via email or phone at [email protected] or 972.813.9788.