The ball is now rolling and it’s official, I’m buying a house. Although I was quite excited, deep down I felt like something was going to happen during this time. I kept wondering why the other lender kept saying I wouldn’t qualify but my new one was like Yes! Would I get so far in my process and it not come true? Honestly, it was these thoughts that stopped me from publicly discussing building a home.

So here we are. It’s May 2017 and I’m starting. It’s getting real. I’m nervous and excited at the same time.

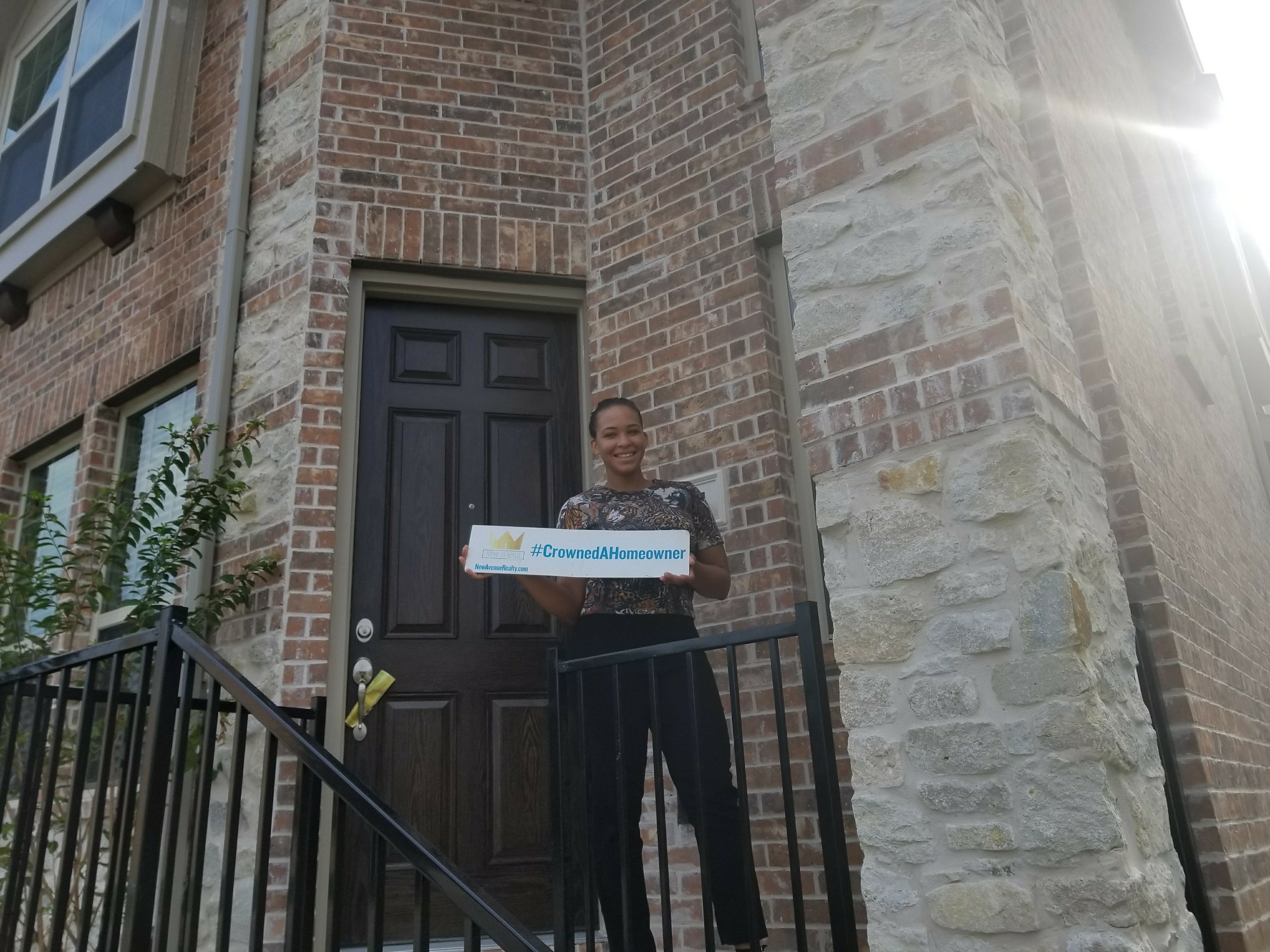

I went away for the Fourth of July weekend at Essence and came back to this.

It was at this moment who I was emotionally invested. I needed to do whatever it took to keep the no and nay says away. It’s July 2017 and my home is slated to be completed in 2 months. I started to pay off EVERYTHING. When I say EVERYTHING, I did everything. That tax bill that I should have paid off in 2016 was finally paid off. Those credit cards were finally paid off. I did whatever the lender saw fit. However, there was a hold up. The lender I was using had internal issues that affected me. I get a call from a random person saying he’s know my loan officer. I am NOT receptive to it. I’ve been working with this particular lender for the company and I like him. He had a Realtor Day at his lake house and I really enjoyed him. Your personal finance is heavily on display when buying a home so it is important to work with someone you can trust. I trusted this guy not the new guy calling. I let that be known and it was told to me that my regular guy would finish up my loan process. Well, two weeks later, they LOCKED him out of the file.

As a Realtor, I understood the internal issues but as the now consumer, I was hot. The communication now lagged because my second lender guy was ON IT. I had questions and he had answers. This mess from the inside meant a delay on getting an answer. I was in debate with should I pay my car off. Can I do this instead? Can we use this program to help offset my DTI (Debt to income ratio because that was really my main issue anyway. It wasn’t my debt more so the income I claimed. I wanted to pay lower taxes so the income that I actually made was lower)? I remember distinctly waiting a week and a half for my question to be answered when I responded 5 minutes later to an original email. It was at that moment that I said GOODBYE.

I didn’t want to be involved in the tussle anymore and communication is MAJOR for me. Buying a home or better yet financing a home is stressful enough. I didn’t need the extra stress. I went back to my sales rep and said okay, who is next on the list. I told her I’d try one of the preferred lenders again and if it didn’t work, I’d go with one of my own lenders and just pay $20K extra because I’d lose my incentives for working with an outside lender.

She recommends Mortgage Financial Services and Jim Ward. I thoroughly explained to Jim what was happening, what I needed, and to guarantee he could get me to the closing table. If he couldn’t do it, just let me know ahead of time. He mentioned he could but I would have to pay off my car. I was trying to avoid that. I was like Jim, “I don’t owe like $2000 on the car. I owe almost $8000 and now we are interfering with the money I have saved for my downpayment. After counting my resources, I knew I had a closing right before the scheduled date to close on my home. In some way, this could work out OR it could end really bad. Just my luck, it got bad before it got good.

I’ve extended this to four parts. I couldn’t add so much for part 3. Thanks for reading and stay tune for the final part next week*