When asked about the market as a REALTOR®️, I’m honest on what it is whether it is a potential seller or buyer asking.

As of today, our #DFW market is still pretty strong. Inventory is ⬆️, which gives buyers more options. However, as a seller, you’ll think the market is crap. As a buyer, you’ll think the same too. Understanding where the local market is and where you can get the best bang for your buck, helps you weather it.

Solutions for both:

Sellers – Today’s market IS NOT the market from the spring. You have to put your home in the best light to get it sold if you want top dollar. No longer will just listing it and waiting for the crowd to appear work. Determine if you want top dollar. If you do, you’ll have to do things to get top dollar in today’s market. That includes pricing it right off the bat, great curb appeal, staging, professional photos, and keeping the home clean and organized. I highly recommend staging for today’s market.

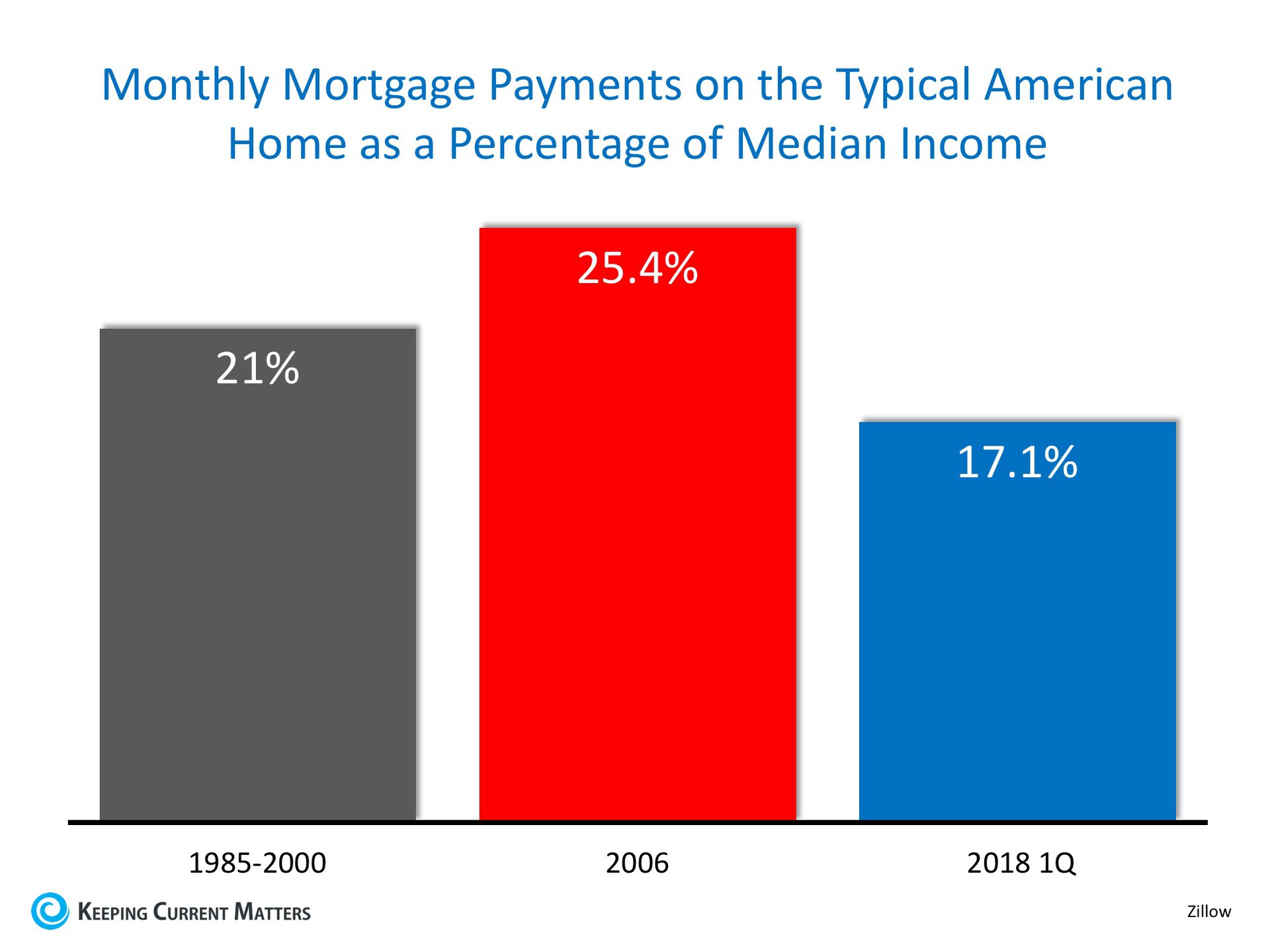

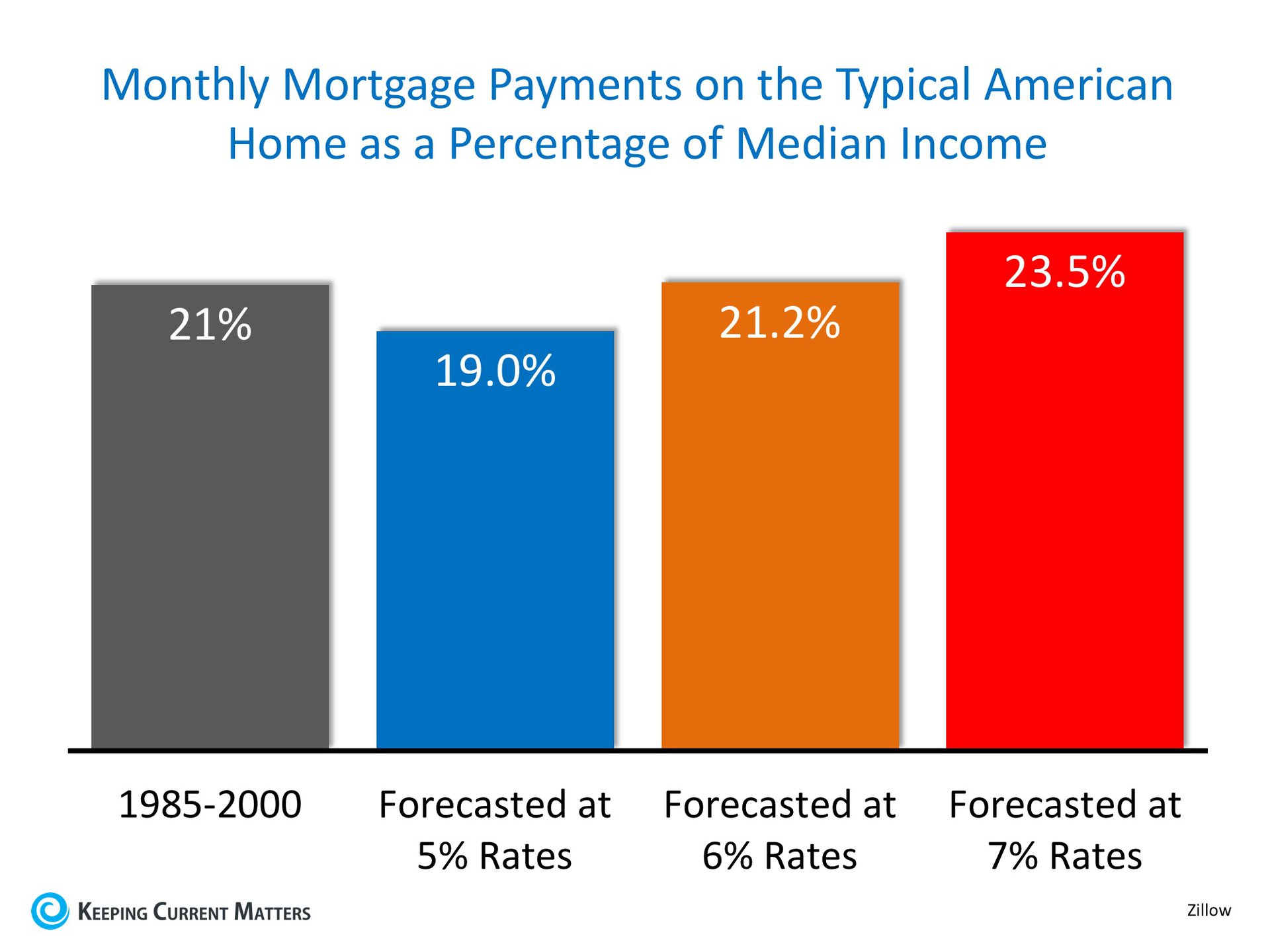

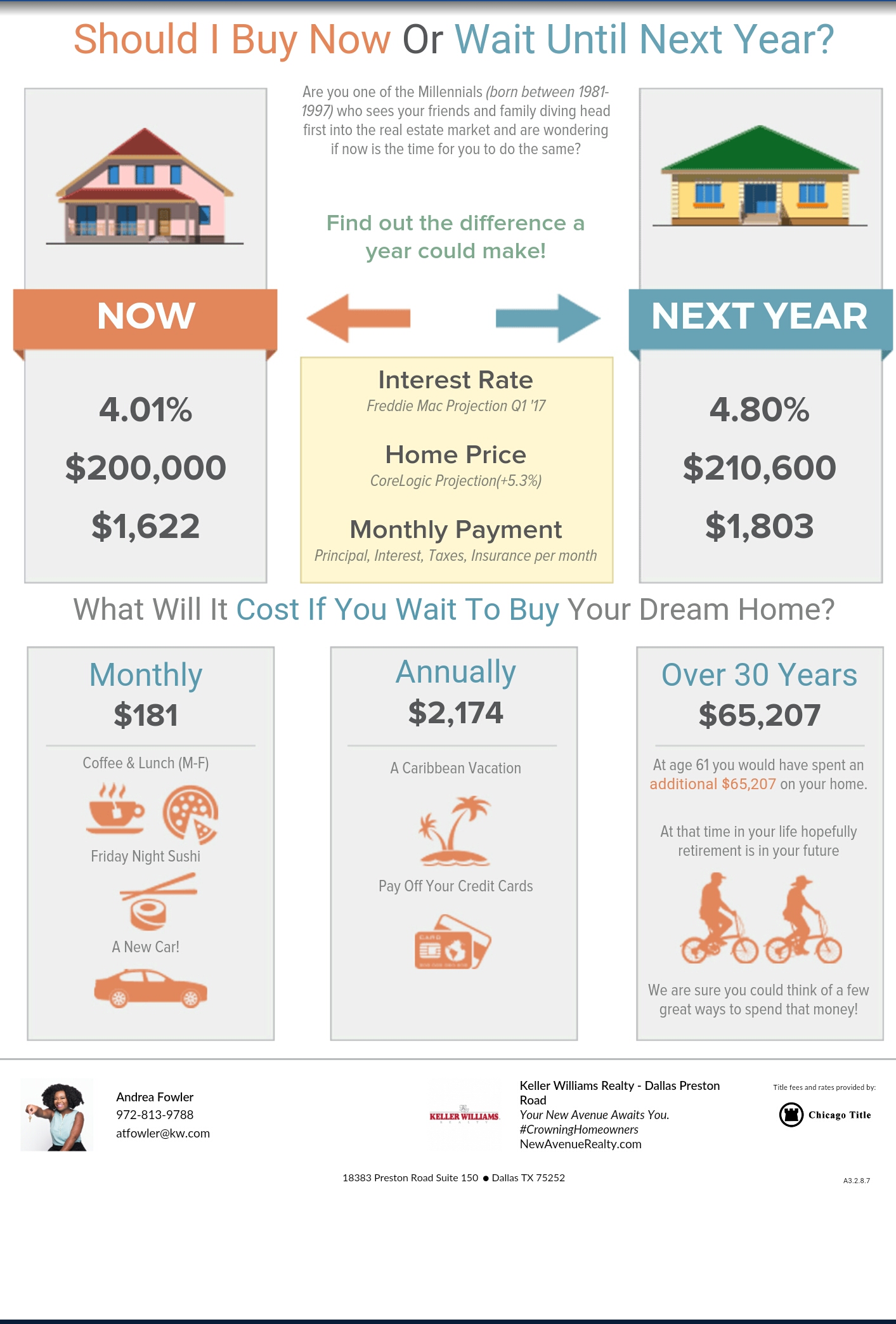

Buyers – Be realistic and understand your local market. I know you’re hearing “rates this and rates that”. What really matters is what you can realistically afford. Rent is at 100% interest that isn’t written off during tax season. This IS NOT 2008 at all. Buy a home you can afford and that fits your lifestyle for the timeframe you want it to be. Understand what you want and what you can afford may be two different things. Find where the two areas collide or adjust based on where you want to be.

Bottom Line: Yes, people are still buying and selling. People will continue to buy and sell because LIFE happens through all the ebbs and flows whether good or bad. The key is to understand what is happening in your local market with a trusted expert.

Save this post for future reference. If you’re ready to chat about homeownership in #DFW, book a consultation with me at calendly.com/newaverealty.