What does it mean to build a home at $800K+? How do those homes look? Are those custom built homes or nah? Join me as a I take sir down with Taylor Robinson to discuss luxury homebuying in Dallas with a production builder.

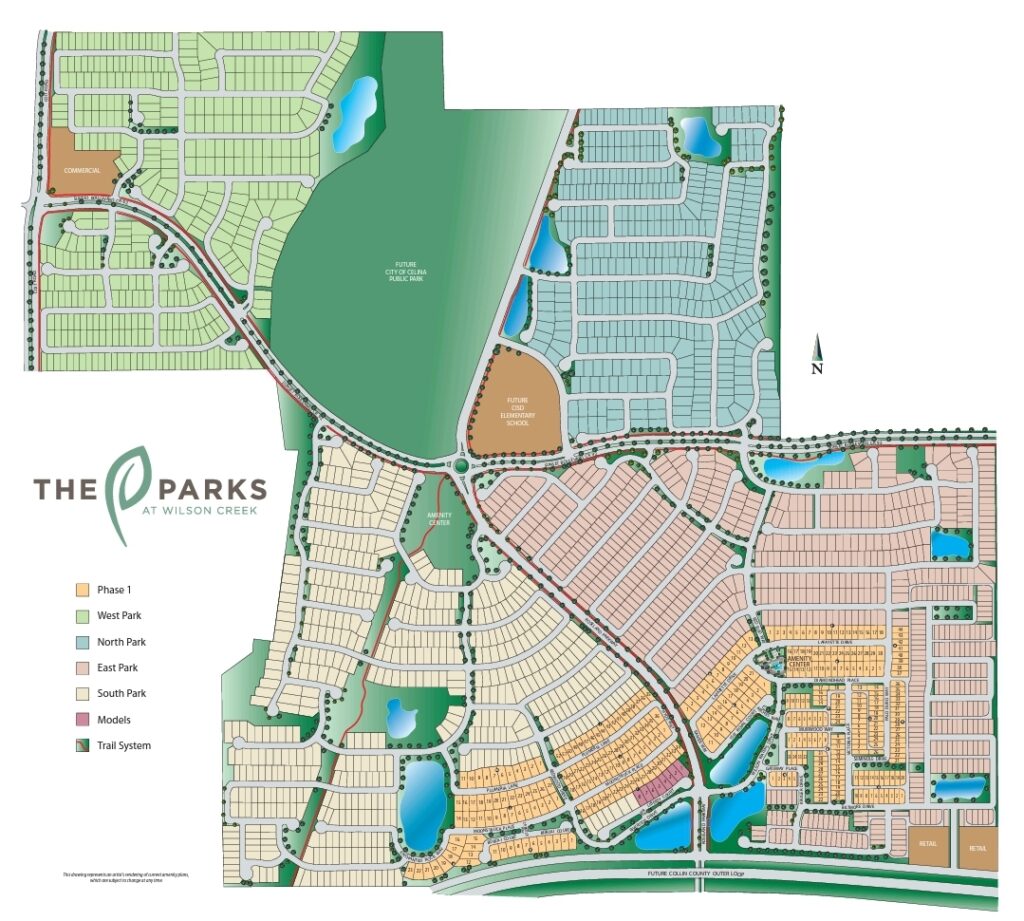

Discover the Best Kept Secret in Celina – Parks at Wilson Creek

If you’re looking for a peaceful, nature-filled community in Celina, Texas, look no further than Parks at Wilson Creek. This charming development offers stunning views, top-notch amenities, and a fantastic location. Whether you’re a first-time home buyer or looking for your next family home, Parks at Wilson Creek has everything you need.

At Parks at Wilson Creek, you’ll find spacious homes with plenty of natural light and breathtaking views of the surrounding landscape. The community is carefully designed to provide residents with a comfortable and relaxed lifestyle, while still being close to all the action in Celina. Whether you’re a nature lover, a fitness enthusiast, or simply looking for a quiet place to call home, Parks at Wilson Creek has something for everyone.

In addition to its fantastic location, Parks at Wilson Creek also offers a wide range of amenities for residents. The community features parks, walking trails, a clubhouse, a swimming pool, and more. Whether you’re looking to stay active and meet new people, or simply relax in a quiet, peaceful setting, Parks at Wilson Creek has everything you need to feel right at home.

If you’re looking for the perfect place to call home in Celina, Texas, look no further than Parks at Wilson Creek. With its fantastic location, top-notch amenities, and stunning views, this community is the best kept secret in Celina. Don’t miss this opportunity to live in one of the most desirable communities in Texas. The builders in the community will be Highland Homes, Perry Homes, Tradition Homes, and David Weekley Homes.

Home prices are starting in the $400s. Contact us today to schedule a tour!

How’s the Market?

When asked about the market as a REALTOR®️, I’m honest on what it is whether it is a potential seller or buyer asking.

As of today, our #DFW market is still pretty strong. Inventory is ⬆️, which gives buyers more options. However, as a seller, you’ll think the market is crap. As a buyer, you’ll think the same too. Understanding where the local market is and where you can get the best bang for your buck, helps you weather it.

Solutions for both:

Sellers – Today’s market IS NOT the market from the spring. You have to put your home in the best light to get it sold if you want top dollar. No longer will just listing it and waiting for the crowd to appear work. Determine if you want top dollar. If you do, you’ll have to do things to get top dollar in today’s market. That includes pricing it right off the bat, great curb appeal, staging, professional photos, and keeping the home clean and organized. I highly recommend staging for today’s market.

Buyers – Be realistic and understand your local market. I know you’re hearing “rates this and rates that”. What really matters is what you can realistically afford. Rent is at 100% interest that isn’t written off during tax season. This IS NOT 2008 at all. Buy a home you can afford and that fits your lifestyle for the timeframe you want it to be. Understand what you want and what you can afford may be two different things. Find where the two areas collide or adjust based on where you want to be.

Bottom Line: Yes, people are still buying and selling. People will continue to buy and sell because LIFE happens through all the ebbs and flows whether good or bad. The key is to understand what is happening in your local market with a trusted expert.

Save this post for future reference. If you’re ready to chat about homeownership in #DFW, book a consultation with me at calendly.com/newaverealty.

Should You Renovate or Move?

The last 18 months changed what many buyers are looking for in a home. Recently, the American Institute of Architects released their AIA Home Design Trends Survey results for Q3 2021. The survey reveals the following:

- 70% of respondents want more outdoor living space

- 69% of respondents want a home office (48% wanted multiple offices)

- 46% of respondents want a multi-function room/flexible space

- 42% of respondents want an au pair/in-law suite

- 39% of respondents want an exercise room/yoga space

If you’re a homeowner who wants to add any of the above, you have two options: renovate your current house or buy a home that already has the spaces you desire. The decision you make could be determined by factors like:

- A possible desire to relocate

- The difference in the cost of a renovation versus a purchase

- Finding an existing home or designing a new home that has exactly what you want (versus trying to restructure the layout of your current house)

In either case, you’ll need access to capital: the funds for the renovation or the down payment your next home would require. The great news is that the money you need probably already exists in your current home in the form of equity.

Home Equity Is Skyrocketing

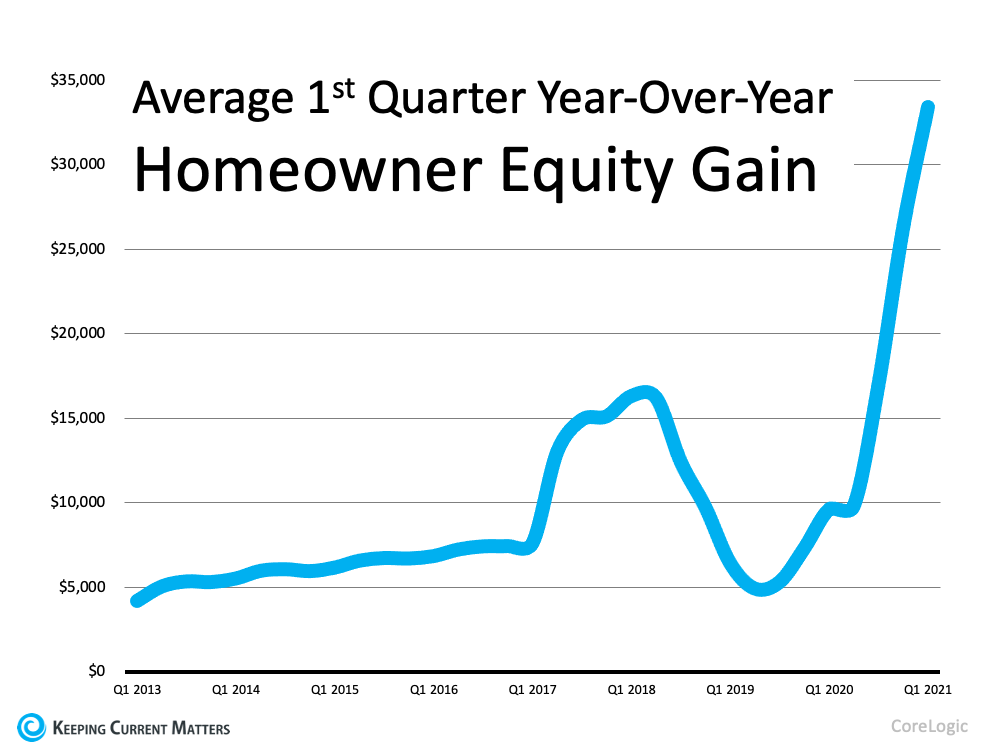

The record-setting increases in home prices over the last two years dramatically improved homeowners’ equity. The graph below uses data from CoreLogic to show the average home equity gain in the first quarter of the last nine years:Odeta Kushi, Deputy Chief Economist at First American, quantifies the amount of equity homeowners gained recently:

“Remember U.S. households own nearly $35 trillion in owner-occupied real estate, just over $11 trillion in debt, and the remaining ~$24 trillion in equity. In inflation adjusted terms, homeowners in Q2 had an average of $280,000 in equity- a historic high.”

As a homeowner, the money you need to purchase the perfect home or renovate your current house may be right at your fingertips. However, waiting to make your decision may increase the cost of tapping that equity.

If you decide to renovate, you’ll need to refinance (or take out an equity loan) to access the equity. If you decide to move instead and use your equity as a down payment, you’ll still need to mortgage the remaining difference between the down payment and the cost of your next home.

Mortgage rates are forecast to increase over the next year. Waiting to leverage your equity will probably mean you’ll pay more to do so. According to the latest data from the Federal Housing Finance Agency (FHFA), almost 57% of current mortgage holders have a mortgage rate of 4% or below. If you’re one of those homeowners, you can keep your mortgage rate under 4% by doing it now. If you’re one of the 43% of homeowners with a mortgage rate over 4%, you may be able to do a cash-out refinance or buy a more expensive home without significantly increasing your monthly payment.

First Step: Determine the Amount of Equity in Your Home

If you’re ready to either redesign your current house or find an existing or newly constructed home that has everything you want, the first thing you need to do is determine how much equity you have in your current home. To do that, you’ll need two things:

- The current mortgage balance on your home

- The current value of your home

You can probably find the mortgage balance on your monthly mortgage statement. To find the current market value of your house, you can pay several hundreds of dollars for an appraisal, or you can contact a local real estate professional who will be able to present to you, at no charge, a professional equity assessment report.

Bottom Line

If the past 18 months have refocused your thoughts on what you want from your house, now may be the time to either renovate or make a move to the perfect home.

4 Ways to Prep Your Home to Sale This Fall

Even in a hot sellers’ market like today’s in which homes are selling so quickly, it’s still important to make a good first impression on potential buyers. Taking the time upfront to prep your house appropriately can bring in the greatest return on your investment.

Here are four simple tips to make sure you maximize the sale of your house this fall.

1. Price It Right

One of the first things buyers will notice is the price of your house. That’s why it’s important to price it right. Your goal in pricing your house is to draw attention from competing buyers and let bidding wars push the final sales price up. Pricing your house too high to begin with could put you at a disadvantage by discouraging buyers from making an offer.

Your trusted real estate advisor can help you find the price for your home that reflects the current market value. Lean on your agent to help you with this crucial first step.

2. Keep It Clean

It may sound simple, but keeping your house clean is key to making sure it gets the attention it deserves. As realtor.com says in the Home Selling Checklist:

“When selling your home, it’s important to keep everything tidy for buyers. . . . Remember to take special care with the bathroom, making sure the tile, counters, shower, and floors shine.”

Before each buyer visits, assess your space and determine what needs your attention. Wash the dishes, make the beds, and put away any toys. Doing these simple things can reduce any potential distractions for buyers.

3. Make It Easy To Visit

Giving buyers the opportunity to see your house on their schedule can be a true game-changer. Buyers are less likely to make an offer if it’s difficult to plan a tour or they can’t easily fit it into their schedule. Making your house available as often as possible helps create opportunities for more buyers to fall in love with your house.

Rest assured your trusted real estate advisor will keep your health and safety top of mind when buyers tour your home. Agents use the latest guidance to stay up to date on any protocols and sanitization recommendations.

4. Help Buyers Feel at Home

Finally, it’s important for buyers to see all the possible ways they can make your house their next home. As the realtor.com article puts it:

“The goal is to create a blank canvas on which buyers can project their own visions of living there, and loving it.”

An easy first step to create this blank canvas is removing personal items – pictures, awards, and sentimental belongings – from your space. If you’re unsure what should be packed away and what can stay, consult your trusted real estate advisor. Spending the time on this step can pay off in the long run, as the 2021 Profile of Home Staging from the National Association of Realtors notes:

“Eighteen percent of sellers’ agents said home staging increased the dollar value of a residence between 6% and 10%.”

Bottom Line

To make the most of today’s sellers’ market, avoid the temptation to skip over the essential preparation steps. Connect with a trusted real estate advisor today to discuss all the ways you can maximize your home sale.

Prices are UP & STUCK….for now!

Are the Prices TOO DAMN HIGH OR NAH?

In the beginning of 2020, the Dallas-Fort Worth marker was headed to a neutral market. Buyers were able to find homes and sellers were able to sell. No problem, right?

Then COVID hit in March 2020 and shut the country down. This left real estate to be in the unknown territory. If we are being truthful, the absolute best time to have bought a house would have been March-June 2020. I won’t say people were giving away their houses but the unknown was so unknown, you could have gotten things that you cannot think to ask of now.

As far as homes are now, today’s market is reflective of supply and demand. Due to a lot of sellers not listing within the last year, builders not being able to keep up with the demand, and buyers looking to get out of rentals, we were hit with a high demand and a shortage of homes.

If you go back to your college Economics class OR high school Civics class, when demand is high and supply is low, the prices go UP! That is what has happened to the real estate market. Still confused? Let’s use the Jordan brand of shoes for example. They only release so many each round. Soooo many people want them, once they sell out, they sell out. However, resellers know they are the most wanted shoe. They KNOW they can resell and get a higher price because the availability is limited. Welp, that’s the housing market and supply and demand.

Are the prices higher, yes? However, it is relative to the market that you see. Is it favorable? Maybe not to some but the market reacts to what it has.

Prior to 2020, the $250K and below market was vanishing from the DFW market. Now, to find homes in that range, you will have to move out in rural areas of the metroplex. The only places that have a little bit of $250K and below left is the Forney-Heartland-Crandall market and the Princeton area market. In 2021, most homes are starting the $350s. In my honest opinion, today’s $300K is yesterday’s $250K with a low interest rate. You can get a higher priced home but that doesn’t mean the higher priced home will be a larger home.

For potential homebuyers, make a list of what you feel is important to have in the first home, determine howlong you plan to live there, and what amenities do you need in and around the neighborhood. Remember, it is the first home. In order to get bells and whistles, you’ll have to pay for it. If that is not an option, reconfigure what you can spend and realistically do for the first home. Build and grow your equity to make the next home your dream home.

Your first home is typically the first step to getting to the dream home.

If you need to discuss more, book a virtual appointment with us at calendly.com/newaverealty.

4 BIG Incentives for Homeowners to Sell Now!

The housing market keeps sailing along. The only headwind that could take it off course is the lack of inventory for sale. The National Association of Realtors (NAR) reports that there were 410,000 fewer single-family homes for sale this March than in March of 2020. The key to continued success in the residential housing market is for more listings to come on the market. However, many homeowners are concerned that selling their homes could be challenging for several reasons.

Recently, Homes.com released the findings of a survey that identified these concerns, as well as what it will take for homeowners to feel comfortable selling their houses. Here are the four major homeowner concerns and a quick explanation of what’s actually happening in the housing market today.

1. Homeowners don’t know if they’ll be able to secure their next home before selling.

In negotiations, leverage is the power that one side may have to influence the other side while moving closer to their negotiating position. A party’s leverage is based on the ability to award benefits or eliminate costs on the other side.

In today’s market, buyers have compelling reasons to purchase a home now:

- To own a home of their own

- To buy before prices continue to appreciate

- To secure a mortgage at a historically low rate, while they last

These buyer needs give the seller tremendous leverage. Most already realize this leverage enables the homeowner to sell at a good price. However, this leverage may also be used to negotiate time to find their next home. The homeowner could sell their home to the buyer at today’s price, which will enable the purchaser to take advantage of current mortgage rates. In return, the buyer might lease the house back to the seller for a pre-determined length of time while the seller finds a new home or has one built.

This gives the buyer what they want while also giving the seller what they need. It’s a true win-win negotiation.

2. Homeowners don’t know if their current home will sell for the asking price or top market price.

This is the perfect time to maximize profits while selling a house. NAR just released a study showing that bidding wars are at an all-time high. The study reveals that when comparing the first quarter of last year to the first quarter of this year, the number of offers on homes for sale doubled from an average of 2.4 to 4.8 offers.

Whenever there’s a bidding war, the price of the item for sale escalates. Bloomberg recently reported:

“For the first time ever, the average U.S. home is selling for above its list price.”

If a seller is looking for a top-dollar sale, there’s no better time to sell than right now.

3. Homeowners don’t know if they will get an offer without their home requiring work or updates.

Again, leverage is the greatest strength a seller has in this market. Due to the lack of homes for sale, many buyers are more willing to take on home improvement projects themselves in order to get the home they’re after.

A recent post on whether or not to renovate before selling notes:

“It may be wise to let future homeowners remodel the bathroom or the kitchen to make design decisions that are best for their specific taste and lifestyle. As a seller, your dollars and time might be better spent working on small cosmetic updates, like refreshing some paint and power washing the exterior. Instead of over-investing in your home with upgrades that the buyers may change anyway, work with a real estate professional to determine the key projects that will maximize your listing, without overdoing it.”

If a seller is worried about doing work or updates on their home, they must realize that today’s historically low inventory likely renders these projects less critical to the sale of the house.

4. Homeowners don’t know if they can have a quick closing process.

When speed is important, there are two points sellers should look at:

- The time it takes to find a buyer for the home

- The time it takes to close the transaction

In the latest Existing Home Sales Report, NAR explains:

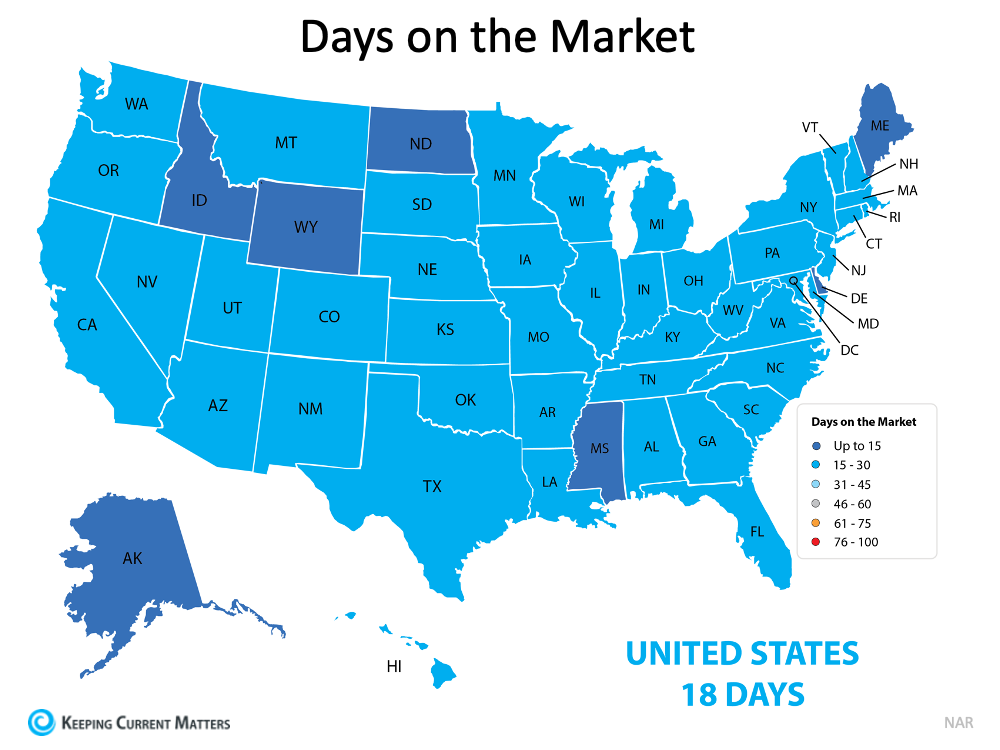

“Properties typically remained on the market for 18 days in March, down from 20 days in February and from 29 days in March 2020. Eighty-three percent of the homes sold in March 2021 were on the market for less than a month.”

Eighteen days is fast, and it’s a new record. Here are the days the average house is on the market in each state:Regarding the time it will take to close the transaction, all-cash sales accounted for 23% of all home purchase transactions in March. All-cash sales can usually be closed in thirty days.

If a mortgage is necessary, the most recent Origination Insight Report from Ellie Mae shows:

“Time to close all loans decreased in March. The average time to close a purchase fell to 51 days, down from 53 the month prior.”

If you’re looking for a quick closing process, there’s never been a market in which the two-step process (finding a buyer and closing the deal) has taken less time.

Bottom Line

Selling your house can be daunting, especially in a fast-paced market. However, the fact that we’re in such a strong sellers’ market clearly eliminates many common concerns. Contact New Avenue Realty Group today to learn more about the opportunities for homeowners who are ready to sell.

SOURCE: KEEPING CURRENT MATTERS

Will There Be MORE Homes to Buy This Year?

If you’re looking for a home to purchase right now and having trouble finding one, you’re not alone. At a time like this when there are so few houses for sale, it’s normal to wonder if you’ll actually find one to buy. According to the National Association of Realtors (NAR), across the country, inventory of available homes for sale is at an all-time low – the lowest point recorded since NAR began tracking this metric in 1982. There are, however, more homes expected to hit the market later this year. Let’s break down the three key places they’ll likely come from as 2021 continues on.

1. Homeowners Who Didn’t Sell Last Year

In 2020, many sellers decided to pause their moving plans for a number of different reasons. From health concerns about the pandemic to financial uncertainty, plenty of homeowners decided not to move last year.

Now that vaccines are being distributed and there’s a light at the end of the COVID-19 tunnel, it should bring some peace of mind to many potential sellers. As Danielle Hale, Chief Economist at realtor.com, notes:

“Fortunately for would-be homebuyers, we expect sellers to return to the market as we see improvement in the economy and progress against the coronavirus.”

Many of the homeowners who decided not to sell in 2020 will enter the market later this year as they begin to feel more comfortable showing their house in person, understanding their financial situation, and simply having more security in life.

2. More New Homes Will Be Built

Last year was a strong year for home builders, and according to the National Association of Home Builders (NAHB), 2021 is expected to be even better:

“For 2021, NAHB expects ongoing growth for single-family construction. It will be the first year for which total single-family construction will exceed 1 million starts since the Great Recession.”

With more houses being built in many markets around the country, homeowners looking for new houses that meet their changing needs will be able to move into their dream homes. When they sell their current houses, this will create opportunities for those looking to find a home that’s already built to do so. It sets a simple chain reaction in motion for hopeful buyers.

3. Those Impacted Financially by the Economic Crisis

Many experts don’t anticipate a large wave of foreclosures coming to the market, given the forbearance options afforded to current homeowners throughout the pandemic. Some homeowners who have been impacted economically will, however, need to move this year. There are also homeowners who didn’t take advantage of the forbearance option or were already in a foreclosure situation before the pandemic began. In those cases, homeowners may decide to sell their houses instead of going into the foreclosure process, especially given the equity in homes today. Lawrence Yun, Chief Economist at NAR, explains:

“Given the huge price gains recently, I don’t think many homes will have to go to foreclosure…I think homes will just be sold, and there will be cash left over for the seller, even in a distressed situation. So that’s a bit of a silver lining in that we don’t expect a massive sale of distressed properties.”

As we can see, it looks like we’re going to have an increase in the number of homes for sale in 2021. With fears of the pandemic starting to ease, new homes being built, and more listings coming to the market prior to foreclosure, there’s hope if you’re planning to buy this year. And if you’re thinking of selling and making a move, doing so while demand for your house is high might create an outstanding move-up option for you.

Bottom Line

Housing demand is high and supply is low, so if you’re thinking of moving, it’s a great time to do so. There are likely many buyers who are looking for a home just like yours, and there are options coming for you to find a new house too. Contact New Avenue Realty Group today to see how you can benefit from the opportunities available in the Dallas-Fort Worth market.

SOURCE: KEEPING CURRENT MATTERS

Get Into This! Target Black Beyond Measure Collection

I am a Target shopaholic any day of the week. A few years ago, my sister gifted me a “Target is My Happy Place” shirt for my birthday. It literally is. If I am feeling stressed or depressed, I just need Target to make it better. ??♀️

My favorite store in the world has a new Black History Month collection called Black Beyond Measure.

Just like last year, this year’s collection is one to grab before they are all out. Here are some goodies that I collected in-store and online.

This post contains affiliate links and I will be compensated if you make a purchase after clicking on my links.

Let’s start with The Lip Bar.

Now, I purchased this a few months ago and felt it was fitting for this blog post. I need to go back and add some of the Mented Cosmetics to my lip collection.

The Items

Partake is a snack company started by a black mom who developed snacks for her daughter who had a severe food allergy. I ordered the cookie butter cookies because how can you say no to cookie butter ANYTHING?

Shea Moisture Wig & Weave Line

If you haven’t heard, I am opening a beauty supply store and I like to try products to see what I would like to carry in my store. This isn’t available by my supplier so I purchased it for myself at Target. I like to switch up my hair style every once in awhile or every 3 days.??♀️ One day it could be crochet braids, the next a curly wig, and the next kinky straight hair. A girl needs OPTIONS!!!

I grabbed all that I could in the store to lay down my wigs and smooth it all out.

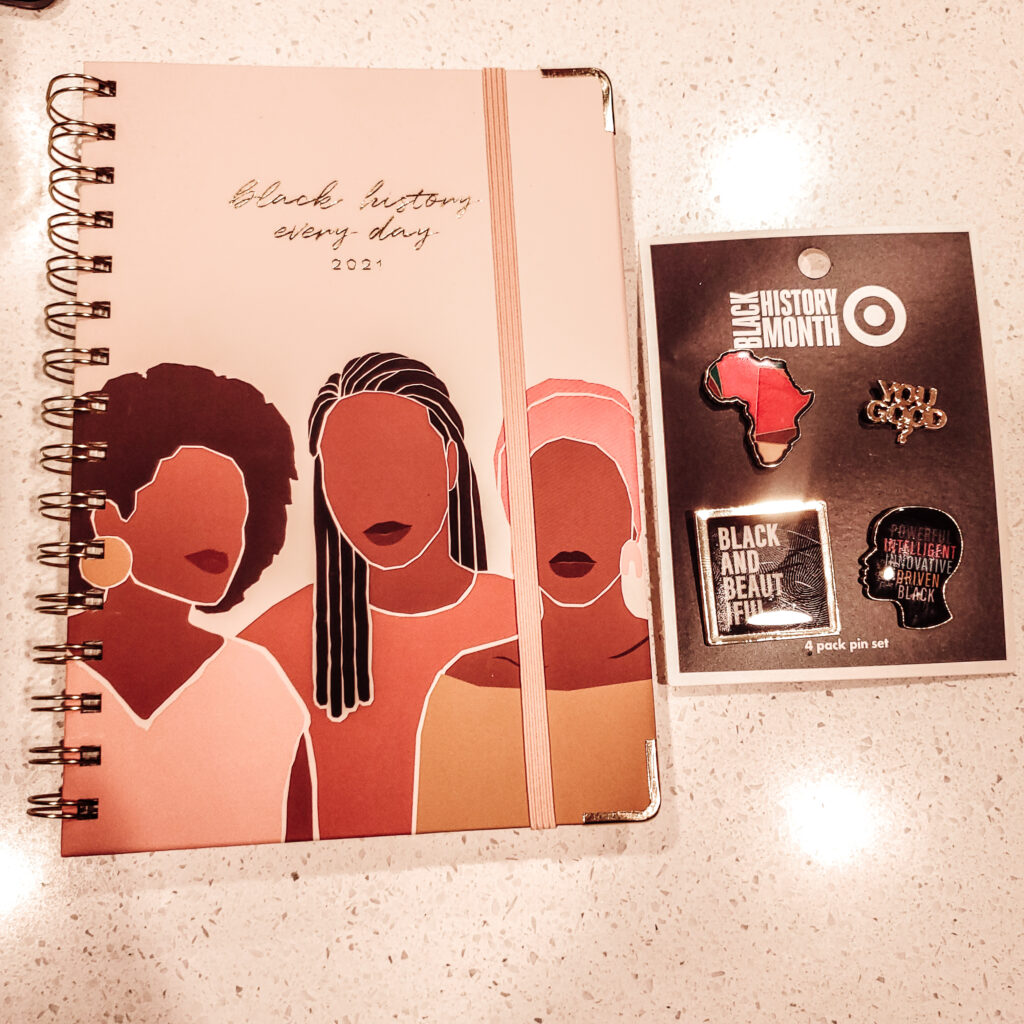

DesignWorks Ink Black History Every 2021 Planner

It is a new year and a new year needs plans. Some of the planners/calendars have pictures that can be turned into 8×8 pictures after the planner is used. Add some #blackgirlmagic to your office, home, and more.

Black History Month Enamel Pins

I’m a hoarder on pins. I rarely wear them but for some reason I love to have them. I’m going to change that in 2021.

Honey Pot Feminine Products

If you missed the whole hoopla last year, you may not have learned about the popular Honey Pot. Now prior to this ordeal in 2020, I became a fan of Honey Pot. I suffer each month from painful periods and just to use their products give me a relief. I had to add more to my collection. The Honey Pot collection has options from feminine pads, tampons, pantyliners, panty spray, etc. I keep wipes in my bathrooms so now visitors will get to see the magic of HoneyPot.

I’ve been to DC a few times and mambo/mumbo sauce is a staple in the area. I decided to add this to my shopping cart to add some flavor to my food since I plan to cook more at home in 2021. I’ll report back in April to tell you if I kept my word on cooking at home.

The Fashions

Now let’s get to the clothes! This is where I tend to do too much at Target. The clothes are always super cute and land in my basket or cart.

I give curls for the girls and this let’s that be known.

I am still awaiting this hoodie and my two year old niece even has one too. I cannot wait to get this one in the mail. Seriously, I am excited. Just purchased one for my nephew and sister. Yes, it will be a family affair or celebration.

Wine Down.

Okay so I saved the best for last. The McBride Sisters. I have been wanting to try this black owned wine brand and didn’t know Target sold them. Now, I couldn’t order this online or even get it curbside. I hopped right into the car to go purchase these. I purchased the McBride Sisters Collection Sparkling Brut Rose, Black Girl Magic Rose, and the Black Girl Magic Red Blends (I gifted this to a neighbor). Target has it where you purchase 4 wines and get 10% off. I grabbed some Stella Rosa to finish my collection. However, there are other wines you can find at other retailers and on their website.

So, what did you think? What are your thoughts on Target’s Black History Month collection? These are the goodies that I personally purchased but if you need more, head here to collect because it will sell out. ✌??

3 Ways Low Inventory Is a WIN for Sellers!

The number of houses for sale today is significantly lower than the high buyer activity in the current housing market. According to Lawrence Yun, Chief Economist for the National Association of Realtors (NAR):

“There is no shortage of hopeful, potential buyers, but inventory is historically low.”

When the demand for homes is higher than what’s available for sale, it’s a great time for homeowners to sell their house. Here are three ways low inventory can help you win if you’re ready to make a move this fall.

1. Higher Prices

With so many more buyers in the market than homes available for sale, homebuyers are frequently entering into bidding wars for the houses they want to purchase. This buyer competition drives home prices up. As a seller, this can definitely work to your advantage, potentially netting you more for your house when you close the deal.

2. Greater Return on Your Investment

Rising prices mean homes are also gaining value, which drives an increase in the equity you have in your home. In the latest Homeowner Equity Insights Report, CoreLogic explains:

“In the second quarter of 2020, the average homeowner gained approximately $9,800 in equity.”

This year-over-year growth in equity gives you the ability to put that money toward a down payment on your next home or to keep it as extra savings.

3. Better Terms

When we’re in a sellers’ market like we are today, you’re in the driver’s seat if you sell your house. You have the power to sell on your terms, and buyers are more likely to work with you if it means they can finally move into their dream home.

So, is low housing inventory a big deal?

Yes, especially if you want to sell your house at the perfect time. Today’s market gives sellers immense negotiating power. However, it won’t last forever, especially as more sellers return to the housing market next year. If you’re considering selling your house, the best time to do so is now.

Bottom Line

If you’re interested in taking advantage of the current sellers’ market, contact a local real estate professional today to determine your best move.

Source: Keeping Current Matters