What does it mean to build a home at $800K+? How do those homes look? Are those custom built homes or nah? Join me as a I take sir down with Taylor Robinson to discuss luxury homebuying in Dallas with a production builder.

Buying this Spring? Be Prepared for Bidding Wars

Traditionally, spring is the busiest season for real estate. Buyers come out in force and homeowners list their houses for sale hoping to capitalize on buyer activity. This year will be no different!

Buyers have already been out in force looking for their dream homes and more are on their way, but the challenge is that the inventory of homes for sale has not kept up with demand, which has lead to A LOT of competition for the homes that are available.

A recent Bloomberg article touched on the current market conditions:

“It’s the 2017 U.S. spring home-selling season, and listings are scarcer than they’ve ever been. Bidding wars common in perennially hot markets like the San Francisco Bay area, Denver and Boston are now also prevalent in the once slow-and-steady heartland, sending prices higher and sparking desperation among buyers across the country.”

Sam Khater, Deputy Chief Economist at CoreLogic went on to explain why buyers are flocking to the market in big numbers:

“In today’s market, many buyers think the trough in [interest] rates is over. If you don’t get in now, it’s just going to be worse later. Rates will be higher, prices will be higher, and maybe inventory selection will be lower.”

In Dallas, homes are staying on the market for almost 16 days with the homes selling at 98.4% of the listing price. Homes under $200,000 sell in 6 days and sell for 100% of list price in North Texas.

Bottom Line

In today’s competitive atmosphere, you need a professional on your side who knows your exact market conditions and can help you take the steps you need to be able to secure your new home! Schedule a buyer’s consultation with New Avenue Realty at atfowlerrealtor.appointy.com.

One More Time…You DO NOT Need 20% Down!

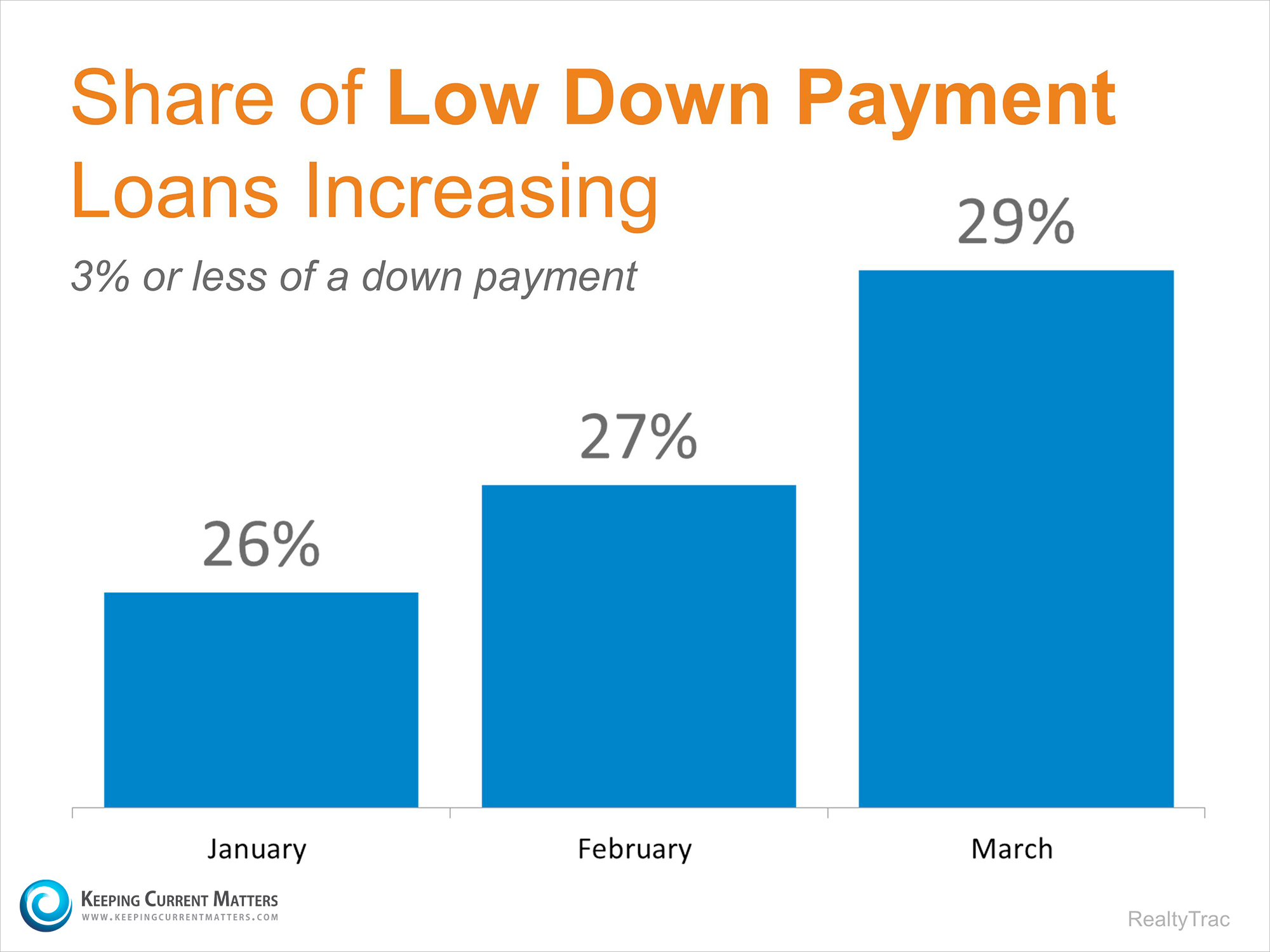

1. Down Payment

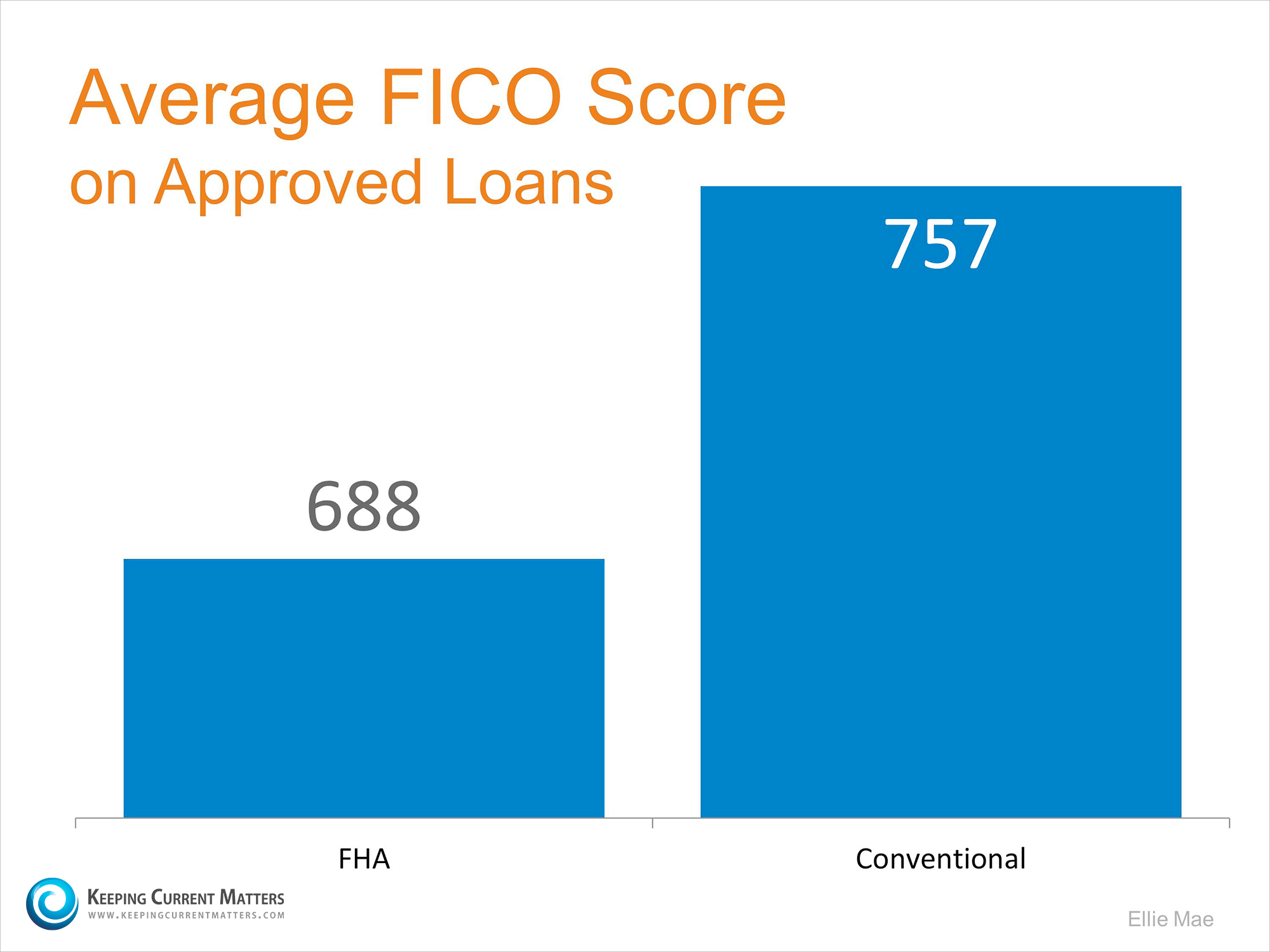

2. FICO Scores

Bottom Line

Buy vs Rent: What Really Creates Family Wealth?

“…as of the end of the first quarter of 2015, the housing market in the U.S. and all cities in the index are trending either closer to renting being the superior option or strictly favoring renting over purchasing a home.”

“The index conducts a “horse race” comparison between an individual that is buying a home and an individual that rents a similar quality home andreinvests all monies otherwise invested in homeownership.”(emphasis added)

“…any extra savings from renting might be spent on non-wealth enhancing goods resulting in any benefits from renting versus owning disappearing in a cloud of consumption spending rather than savings.”

The Concept of ‘Forced Savings’ and Wealth Accumulation

“Homeownership requires potential buyers to save for a down payment, and forces them to continue to save by paying down a portion of the mortgage principal each month.”“Even in instances where renters have excess cash, saving a substantial amount is difficult without a near-term goal, like a down payment. It is also difficult to systematically invest each month in stocks, bonds or other assets without being compelled to do so.”

“Since many people have trouble saving and have to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings to another day.”

The Truth is in the Historical Data

Bottom Line

“Homeownership long has been central to Americans’ ability to amass wealth; even with the substantial decline in wealth after the housing bust, the net worth of homeowners over time has significantly outpaced that of renters, who tend as a group to accumulate little if any wealth…As a means to building wealth, there is no practical substitute for homeownership.”

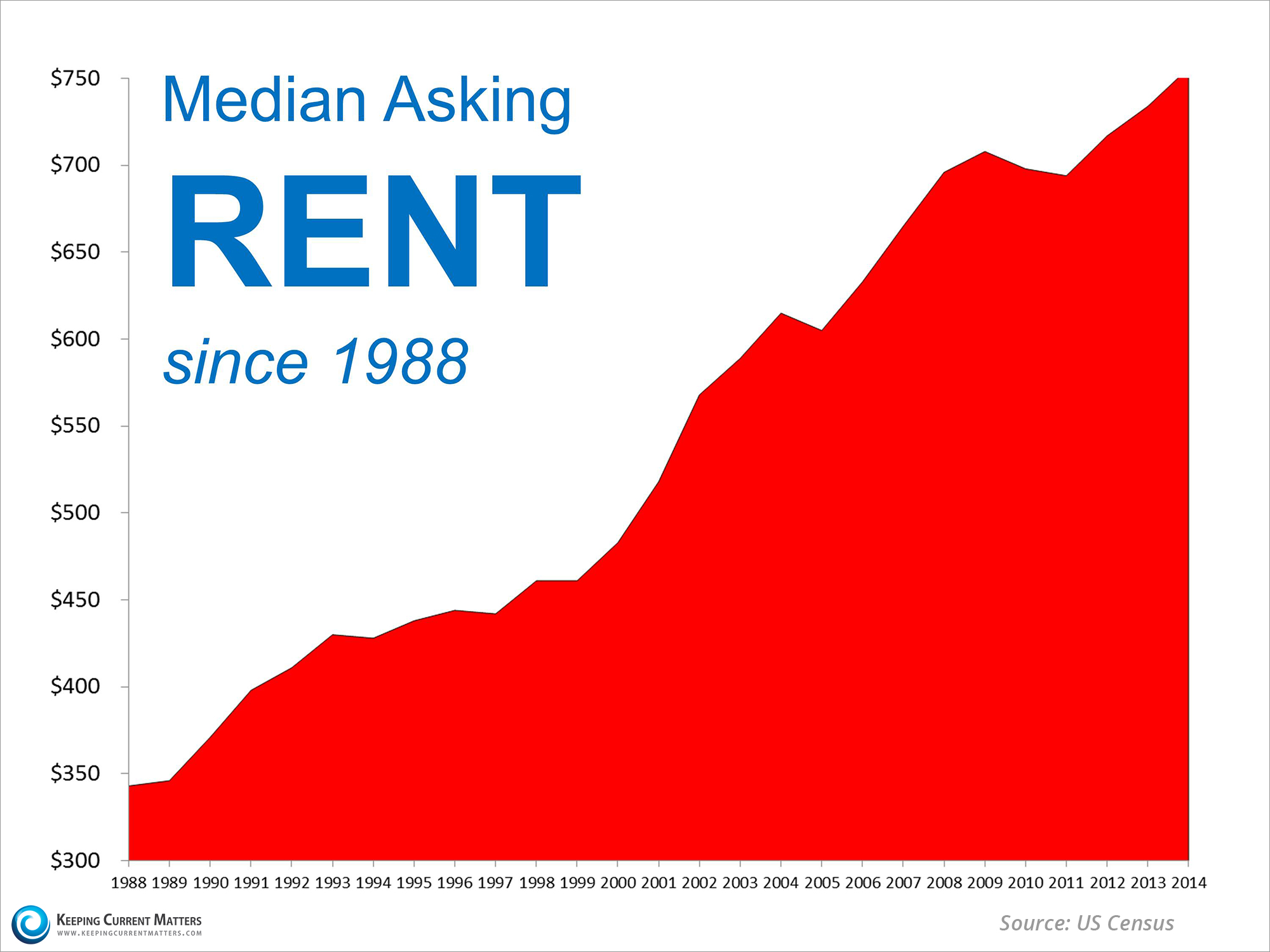

Guess Where Residential Rents are Heading?

“Apartment rental increases slowed in the first quarter from a year earlier, but the move is more likely a temporary blip than the beginning of a long-term respite for renters.”

“I wish I had a better story to tell renters these days, but I think they’re in for some rent increases for the foreseeable future.”

“As a landlord I can tell you I don’t pay property tax. I don’t pay for repairs. The tenant pays. I get my money off the top.”

You Want to Raise My Rent How Much?

“We are focusing aggressively on rent bumps,” American Residential Properties CEO Stephen Schmitz said during a panel discussion. “There’s a supply imbalance in some markets. The same thing that keeps occupancy high also drives rents.”

How Much Are They Going To Raise Your Rent?

“The focus is now on optimizing revenue, compared to getting heads in beds,”

So What Can You Do?

Rents at an All-Time High in North Texas?

If you have lived in an apartment in the Dallas/Fort Worth region, you know that paying for a peace of security and safety does not come cheap no matter where in the metroplex you decide to live. Last year, 2014, rents reached an all time high in North Texas. According to Jenny Doren and Sandra Baker of WFAA and the Star- Telegram:

“Rents rose 4.9 percent in 2014 and now the average monthly rent for an apartment in Dallas-Fort Worth is $919, said MPF Research in Dallas.

“Annual increases above 4 percent are rare in this market,” said Greg Willett, an MPF Research vice president. “Because we’re such a construction hot spot, the flow of new product moving through initial lease-up normally holds rent growth below the national norm.”

Locally, however, renters were leasing up units almost as fast as they came on the market, Willett said. Renters leased 15,226 units during 2014, when 15,575 units were completed, making North Texas the strongest market nationwide.”

I would to talk to you if you are considering purchasing a home in 2015. Let’s get you on a Royal Plan today to see where your new avenue awaits you at. Contact me via phone or email at 972.813.9788 or [email protected].

Find your new avenue here: New Avenue Realty

Doren, Jenny, and Sandra Baker. “N. Texas Apartment Rents Reach an All-time High in 2014.” WFAA. N.p., 6 Jan. 2015. Web. 26 Jan. 2015.

Thank You — New Avenue Realty Home Owners of 2014

Can you believe that 2014 is 2 weeks from being over? Seriously this year has come and gone. We are on the brink of 2015 and New Avenue Realty has some AMAZING plans for 2015 I promise you do not want to miss out.

New Avenue Realty’s Refer A Friend Rewards

|

| Refer A Friend |

Starting January 1st, I will be starting my refer a friend rewards program. For each referral sent, you will be entered in a drawing to win a prize each month for referrals. Your referral must schedule a buyer or seller appointment in order for you to be entered into the contest. The more times you refer a friend, the more times you are entered for the monthly and grand prize drawing. You can start today here: New Avenue Refer A Friend Program

The Grand Prize will be 2 tickets to a Dallas Mavericks basketball game in December 2015. So who will be our first winner of the “Refer A Friend” Rewards?

For more information about the rewards program, contact me at 972.813.9788 or email me.

P.S. Friends don’t let friends search on Zillow or Trulia when there is a North Texas Realtor ready and willing to work so that they get the best real estate deal.

Millenials Set to Take Over Real Estate in 2015?

Just a few months ago, I wrote a blog post titled “Millenials and Real Estate” It is being predicted that millenials will be one of the biggest first time home buyers in 2015. According to Realtor.com, the best purchase markets for millenials are the following:

- Austin, Texas

- Dallas

- Denver

- Des Moines, Iowa

- Grand Rapids, Michigan

- Minneapolis

- New Orleans

- Ogden, Utah

- Salt Lake City

- Seattle

|

| Dallas Skyline at Dusk – Pixabay |